The Value of a Checkbook Calendar: A Comprehensive Guide for 2026-2027

Related Articles: The Value of a Checkbook Calendar: A Comprehensive Guide for 2026-2027

Introduction

With great pleasure, we will explore the intriguing topic related to The Value of a Checkbook Calendar: A Comprehensive Guide for 2026-2027. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Value of a Checkbook Calendar: A Comprehensive Guide for 2026-2027

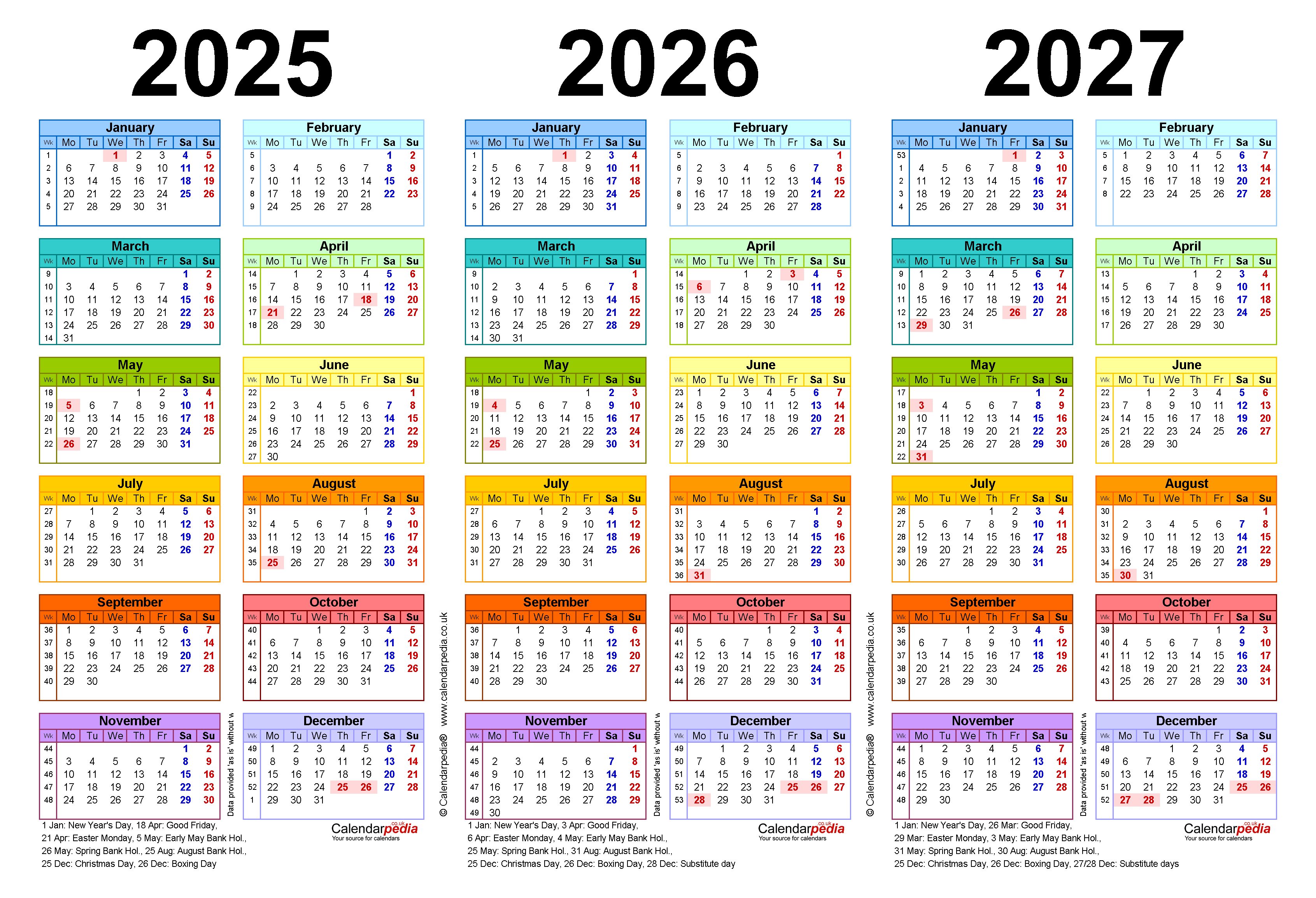

In the digital age, where smartphones and online calendars reign supreme, the humble checkbook calendar might seem like a relic of the past. However, for many individuals and businesses, particularly those who prefer a tangible and organized approach to financial management, a checkbook calendar remains an indispensable tool. This guide delves into the benefits and practical applications of a checkbook calendar, focusing on the years 2026 and 2027.

Understanding the Essence of a Checkbook Calendar

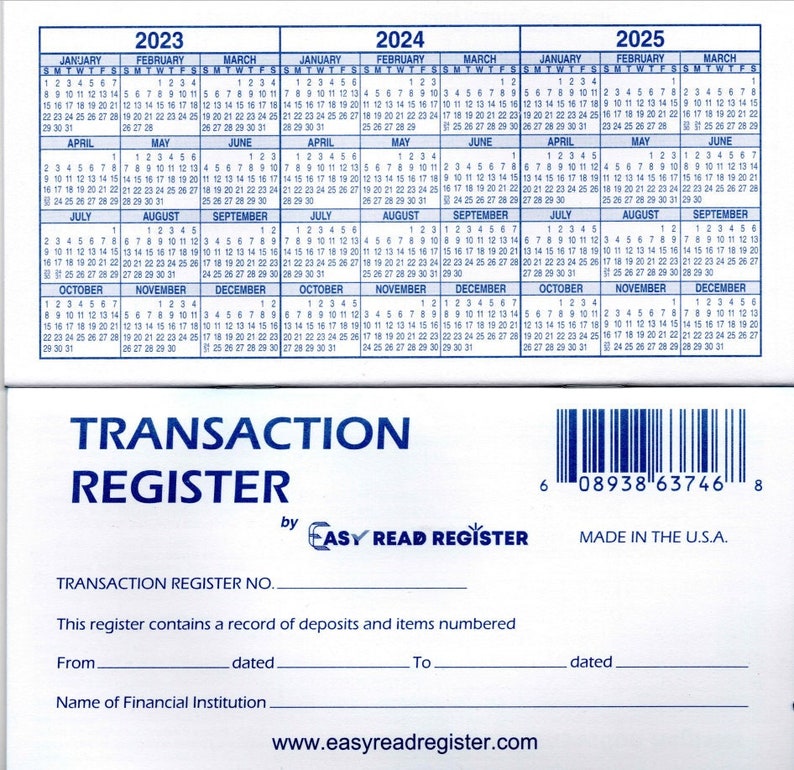

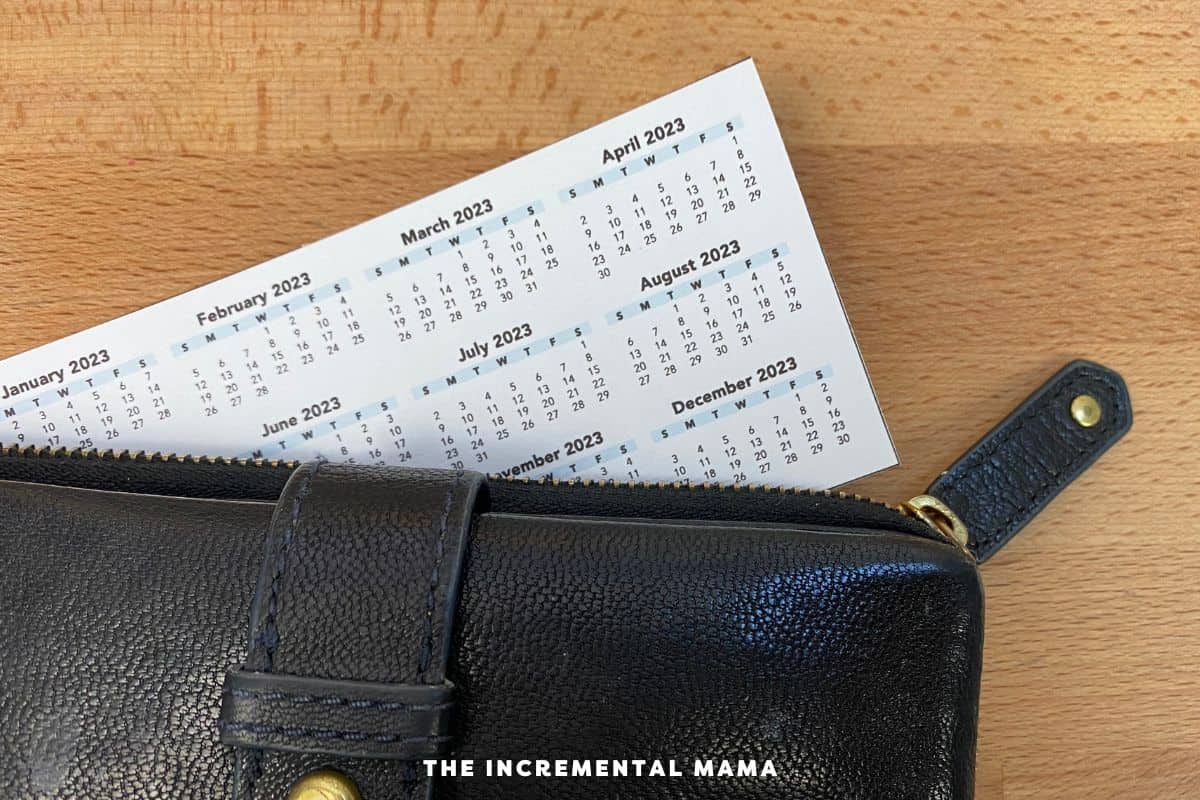

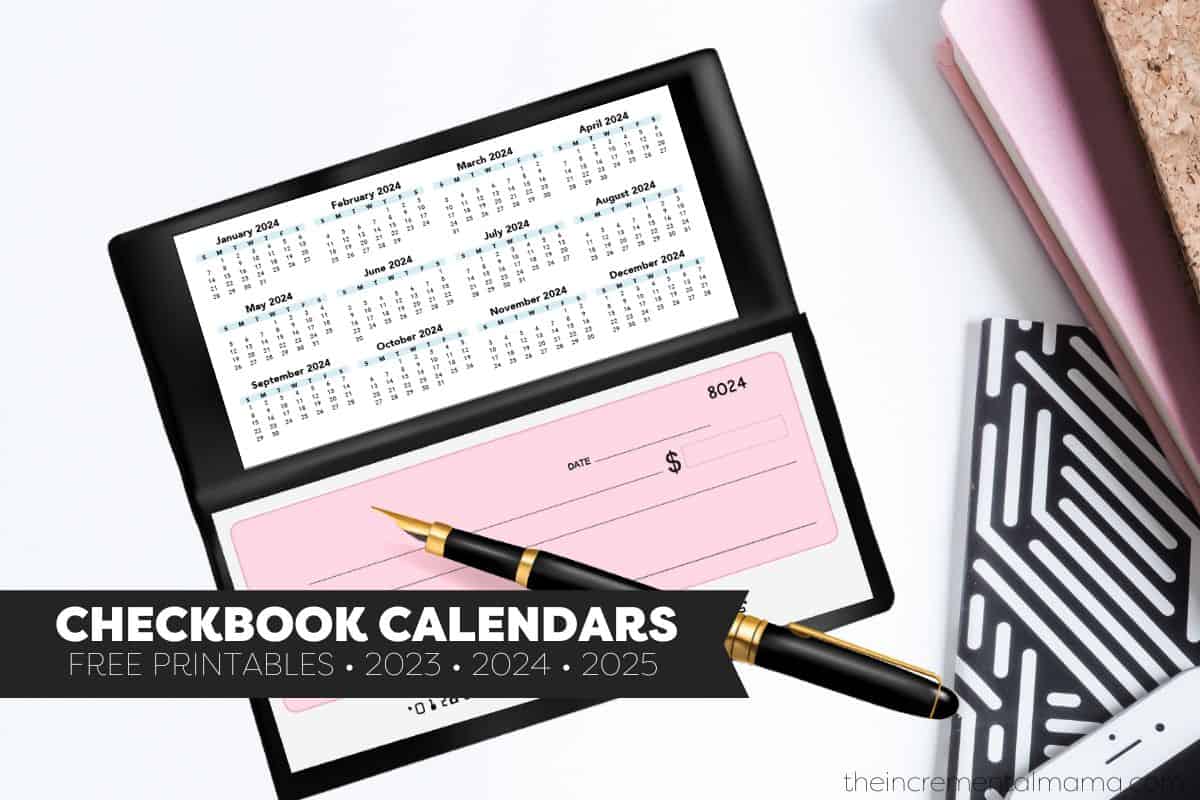

A checkbook calendar is a compact, typically pocket-sized booklet that combines a calendar with a space for recording financial transactions. This unique combination offers a simple yet effective method for tracking income, expenses, and upcoming financial obligations. Its structure is designed to foster a clear overview of one’s financial activities within a given month and year.

The Advantages of Using a Checkbook Calendar

-

Enhanced Financial Organization: The primary benefit of a checkbook calendar is its ability to streamline financial management. By recording every transaction, users gain a comprehensive picture of their income and expenses. This detailed record facilitates budget planning, identifying spending patterns, and ensuring timely bill payments.

-

Improved Budgeting and Savings: With a checkbook calendar, individuals can effectively track their spending habits and identify areas where they can cut back. This enables them to allocate funds more strategically, prioritize savings goals, and achieve greater financial control.

-

Simplified Bill Payment Management: The calendar format allows users to schedule bill payments in advance, minimizing the risk of late fees and missed deadlines. This feature is particularly valuable for individuals managing multiple bills and subscriptions.

-

Increased Financial Awareness: By meticulously recording transactions, users gain a deeper understanding of their financial situation. This heightened awareness fosters responsible spending habits and promotes financial discipline.

-

Tangible Record Keeping: In an increasingly digital world, a physical checkbook calendar provides a tangible record of financial transactions. This can be especially beneficial for individuals who prefer a hands-on approach to record keeping and find it easier to manage information in a physical format.

Beyond Basic Functionality: Additional Features and Applications

While the core function of a checkbook calendar revolves around financial tracking, modern versions often incorporate additional features that enhance their utility:

-

Goal Setting and Tracking: Some checkbook calendars provide space for setting financial goals and tracking progress towards achieving them. This integrated approach fosters a proactive mindset towards financial planning and encourages consistent progress.

-

Debt Management Tools: Certain calendars include sections for debt management, allowing users to track outstanding balances, interest rates, and payment schedules. This feature aids in prioritizing debt repayment and minimizing financial burdens.

-

Investment Tracking: Some checkbook calendars incorporate space for recording investment transactions, providing a centralized platform for monitoring investment performance and portfolio growth.

-

Personalized Notes and Reminders: Many checkbook calendars offer space for writing notes and reminders, allowing users to jot down important financial information, appointments, or other personal notes.

Utilizing a Checkbook Calendar Effectively

To maximize the benefits of a checkbook calendar, consider these practical tips:

-

Consistency is Key: Maintain a consistent recording routine to ensure accuracy and avoid missing transactions.

-

Categorize Expenses: Group expenses into categories (e.g., groceries, utilities, entertainment) to gain a clearer understanding of spending patterns.

-

Review Regularly: Periodically review the calendar to assess progress towards financial goals, identify potential areas for improvement, and adjust spending habits accordingly.

-

Utilize Additional Features: Take advantage of any additional features, such as goal setting, debt management tools, or investment tracking, to enhance the functionality of the calendar.

-

Keep It Accessible: Store the checkbook calendar in a convenient location for easy access and regular use.

Frequently Asked Questions

Q: Are checkbook calendars still relevant in the digital age?

A: While digital tools are prevalent, checkbook calendars remain relevant for those who prefer tangible record keeping, appreciate the visual overview of their finances, and value a simple, hands-on approach to financial management.

Q: Can I use a checkbook calendar for multiple accounts?

A: Yes, you can use a checkbook calendar to track transactions from multiple accounts, such as checking, savings, or credit card accounts.

Q: Are there checkbook calendars specifically designed for businesses?

A: Yes, there are checkbook calendars designed for businesses, offering features such as invoice tracking, expense reporting, and cash flow management.

Q: How often should I review my checkbook calendar?

A: Ideally, review your checkbook calendar at least monthly to assess progress towards financial goals, identify spending patterns, and ensure timely bill payments.

Conclusion

In an era of digital financial tools, the checkbook calendar remains a valuable resource for individuals seeking a structured and organized approach to financial management. Its simplicity, tangibility, and ability to foster financial awareness continue to make it a relevant and useful tool for achieving financial goals and maintaining financial stability. Whether you prefer a traditional approach to record keeping or seek a supplementary tool for managing your finances, a checkbook calendar can be a valuable asset in your financial journey.

Closure

Thus, we hope this article has provided valuable insights into The Value of a Checkbook Calendar: A Comprehensive Guide for 2026-2027. We appreciate your attention to our article. See you in our next article!