Navigating the Queensland Government Payroll Calendar: A Comprehensive Guide for 2026

Related Articles: Navigating the Queensland Government Payroll Calendar: A Comprehensive Guide for 2026

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Queensland Government Payroll Calendar: A Comprehensive Guide for 2026. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Queensland Government Payroll Calendar: A Comprehensive Guide for 2026

The Queensland Government Payroll Calendar serves as a crucial tool for managing employee compensation and ensuring timely and accurate payments. Understanding its structure and key dates is essential for both employees and departmental administrators. This guide provides a detailed overview of the 2026 calendar, outlining its significance, key features, and practical implications.

Understanding the Calendar’s Structure:

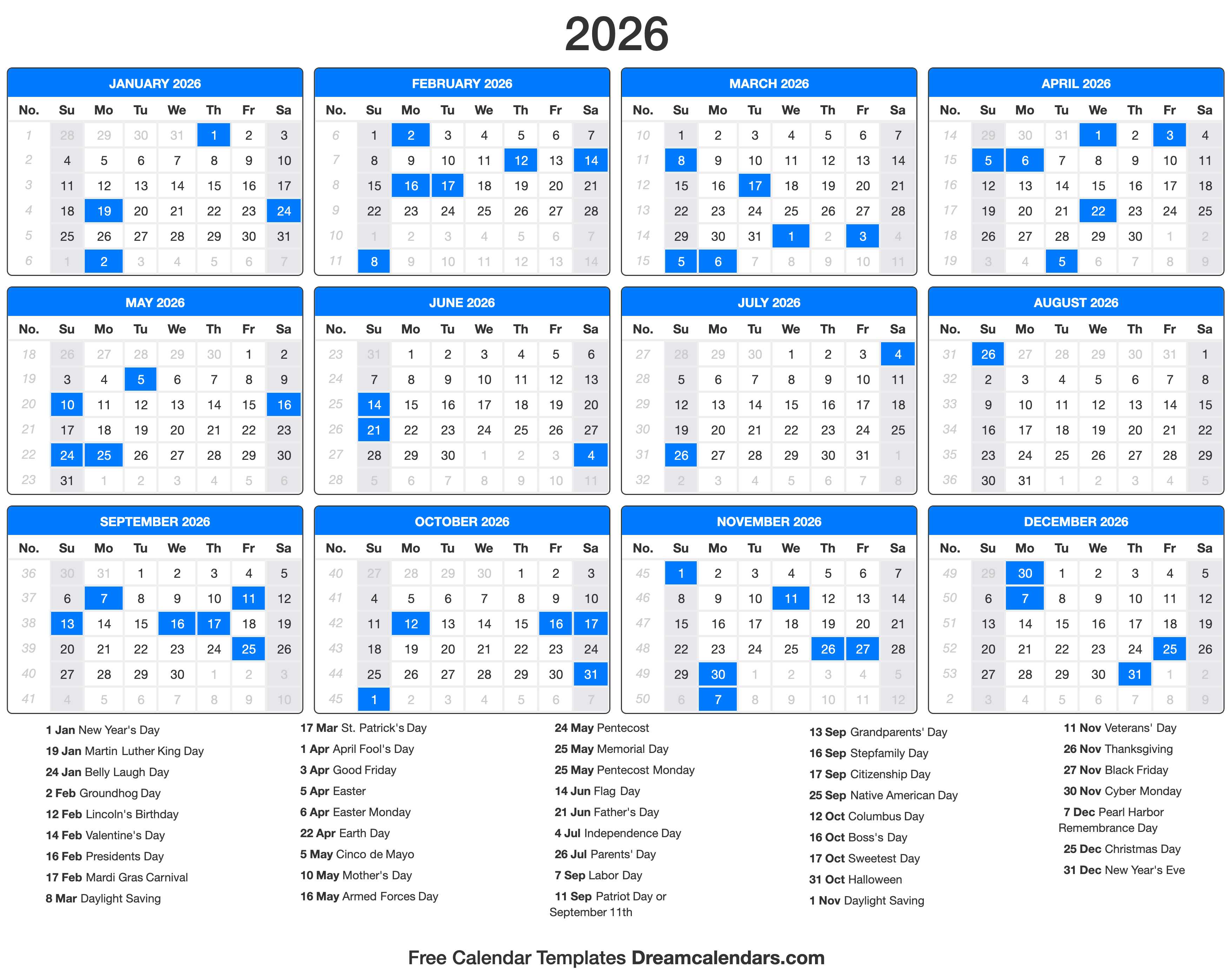

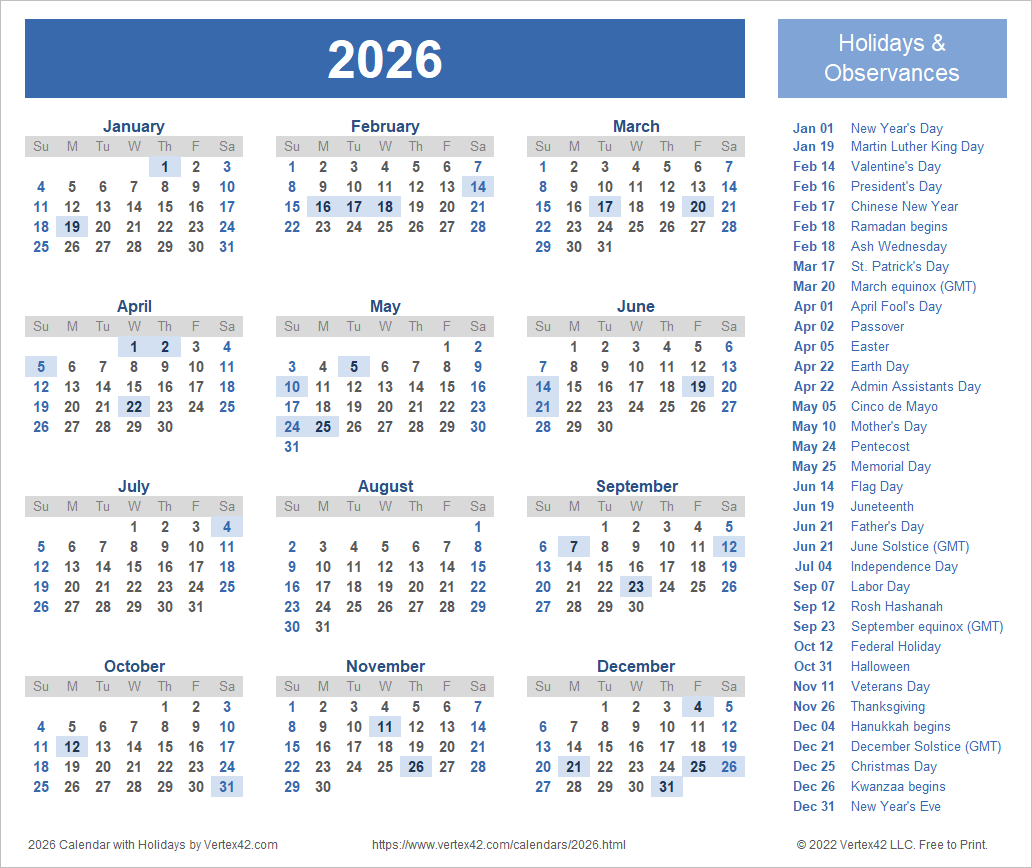

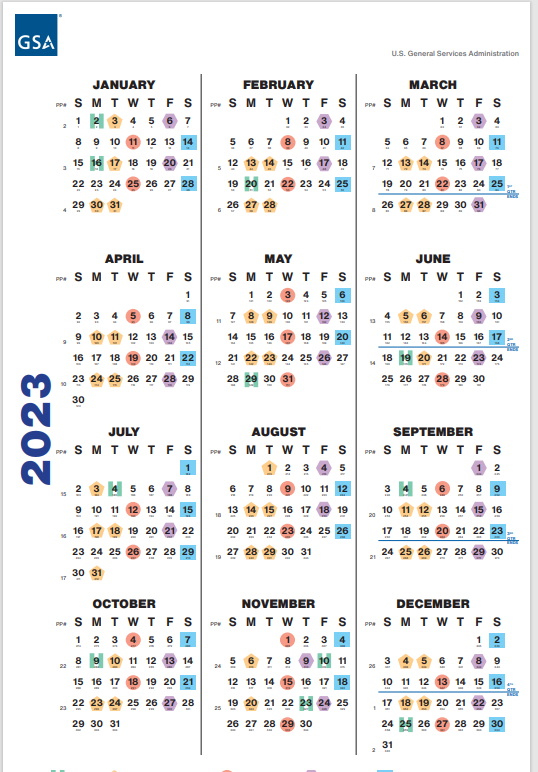

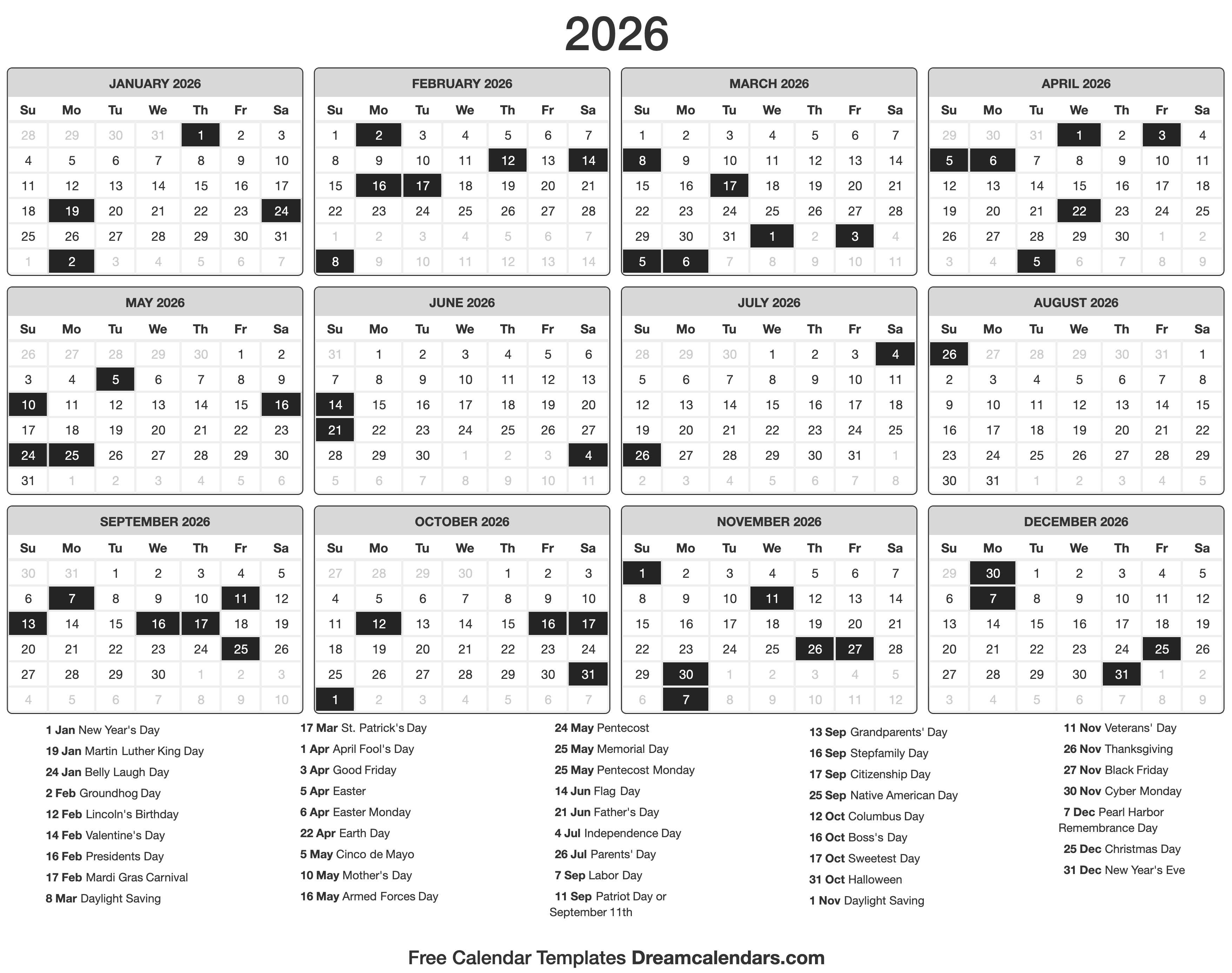

The Queensland Government Payroll Calendar operates on a bi-weekly cycle, with paydays occurring every fortnight. Each calendar year is divided into 26 pay periods, each encompassing a specific timeframe. The calendar clearly defines the pay dates, cut-off dates for timesheet submissions, and other relevant dates for each pay period.

Key Dates and Their Importance:

- Pay Dates: These are the days on which employees receive their salaries. The calendar specifies these dates for each pay period, enabling employees to plan their finances accordingly.

- Cut-off Dates: These dates mark the deadline for submitting timesheets and other relevant documentation for payroll processing. Missing the cut-off date can lead to delays in salary payments.

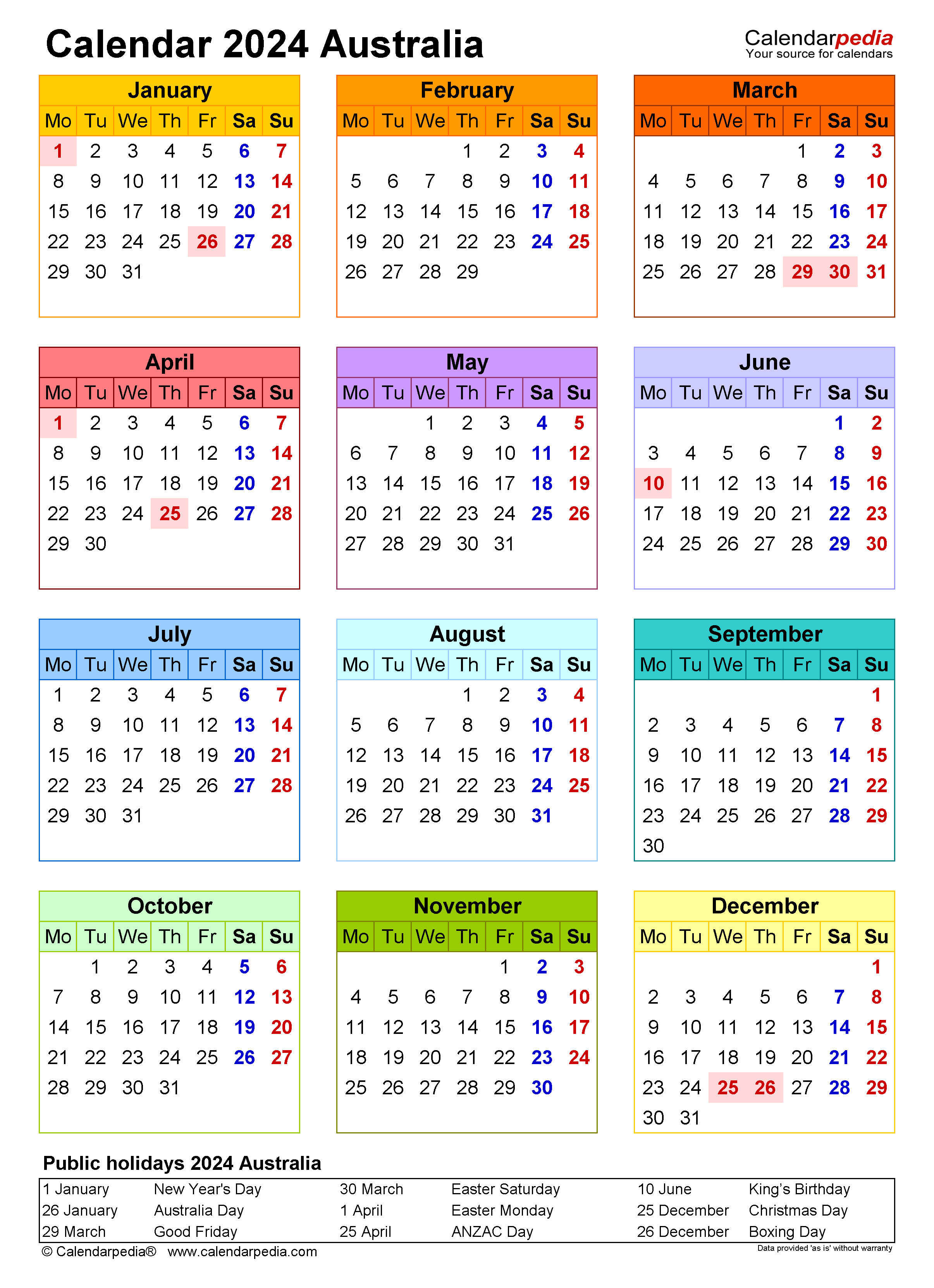

- Public Holidays: The calendar incorporates public holidays, which impact payroll processing. These days are typically non-working days for employees, and payroll adjustments may be necessary.

- Other Important Dates: The calendar may also include dates for specific payroll events, such as annual leave accrual calculations, superannuation contributions, and tax deductions.

Benefits of Utilizing the Payroll Calendar:

- Enhanced Financial Planning: The calendar allows employees to plan their finances effectively by providing clear pay dates and cut-off dates.

- Improved Payroll Efficiency: Departments can streamline payroll processing by adhering to the calendar’s schedule, ensuring timely and accurate payments.

- Minimized Errors and Delays: By adhering to the calendar’s guidelines, departments can minimize the occurrence of payroll errors and delays, reducing frustration for both employees and administrators.

- Transparency and Accountability: The calendar promotes transparency and accountability in payroll management by providing a clear and accessible reference point for all stakeholders.

Navigating the 2026 Calendar:

The Queensland Government Payroll Calendar for 2026 is available online through the relevant government website. The calendar is typically published in advance, allowing ample time for planning and preparation.

Frequently Asked Questions:

Q: What happens if I miss the cut-off date for timesheet submission?

A: Missing the cut-off date may result in a delay in your salary payment. It is crucial to submit your timesheets on time to ensure timely processing. Contact your department’s payroll team for assistance if you encounter any issues.

Q: How do I access the 2026 Payroll Calendar?

A: The calendar is typically accessible on the Queensland Government website. You can locate it by searching for "Queensland Government Payroll Calendar 2026."

Q: Are there any specific guidelines for submitting timesheets?

A: Yes, there are specific guidelines for submitting timesheets. These guidelines are typically outlined in your department’s policies and procedures. Ensure you familiarize yourself with these guidelines to avoid any errors.

Q: What if I am a new employee and haven’t received my first pay yet?

A: If you are a new employee, your department’s payroll team will guide you through the onboarding process, including your first pay date and any necessary paperwork.

Tips for Effective Payroll Management:

- Familiarize yourself with the calendar: Review the calendar regularly to stay informed about pay dates, cut-off dates, and other important events.

- Submit timesheets on time: Ensure you submit your timesheets before the specified cut-off date to avoid delays in payment.

- Communicate with your department’s payroll team: If you encounter any issues or have questions, contact your department’s payroll team for assistance.

- Maintain accurate contact information: Ensure your department has your current contact details to facilitate communication regarding payroll matters.

Conclusion:

The Queensland Government Payroll Calendar is an essential tool for managing employee compensation effectively. By understanding its structure, key dates, and guidelines, both employees and departments can ensure timely and accurate payroll processing. The calendar promotes financial planning, enhances efficiency, minimizes errors, and fosters transparency and accountability in payroll management.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Queensland Government Payroll Calendar: A Comprehensive Guide for 2026. We thank you for taking the time to read this article. See you in our next article!