Navigating the Fiscal Year 2026 Pay Period Calendar: A Comprehensive Guide

Related Articles: Navigating the Fiscal Year 2026 Pay Period Calendar: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Fiscal Year 2026 Pay Period Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Fiscal Year 2026 Pay Period Calendar: A Comprehensive Guide

Understanding the fiscal year (FY) 2026 pay period calendar is crucial for individuals and organizations alike. This calendar dictates the timing of payroll processing, impacting everything from employee compensation and tax obligations to financial planning and budgeting.

Understanding the Fiscal Year and Pay Periods

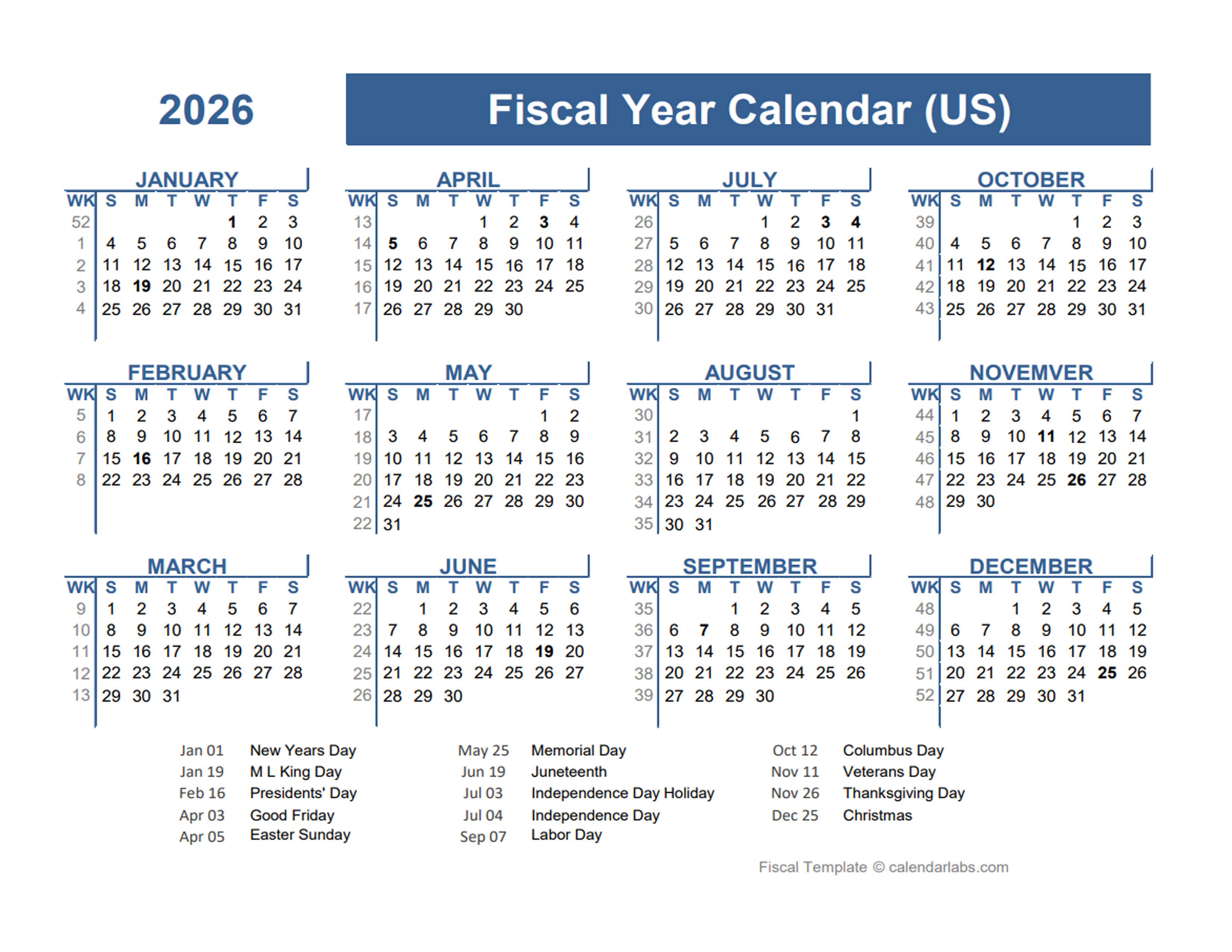

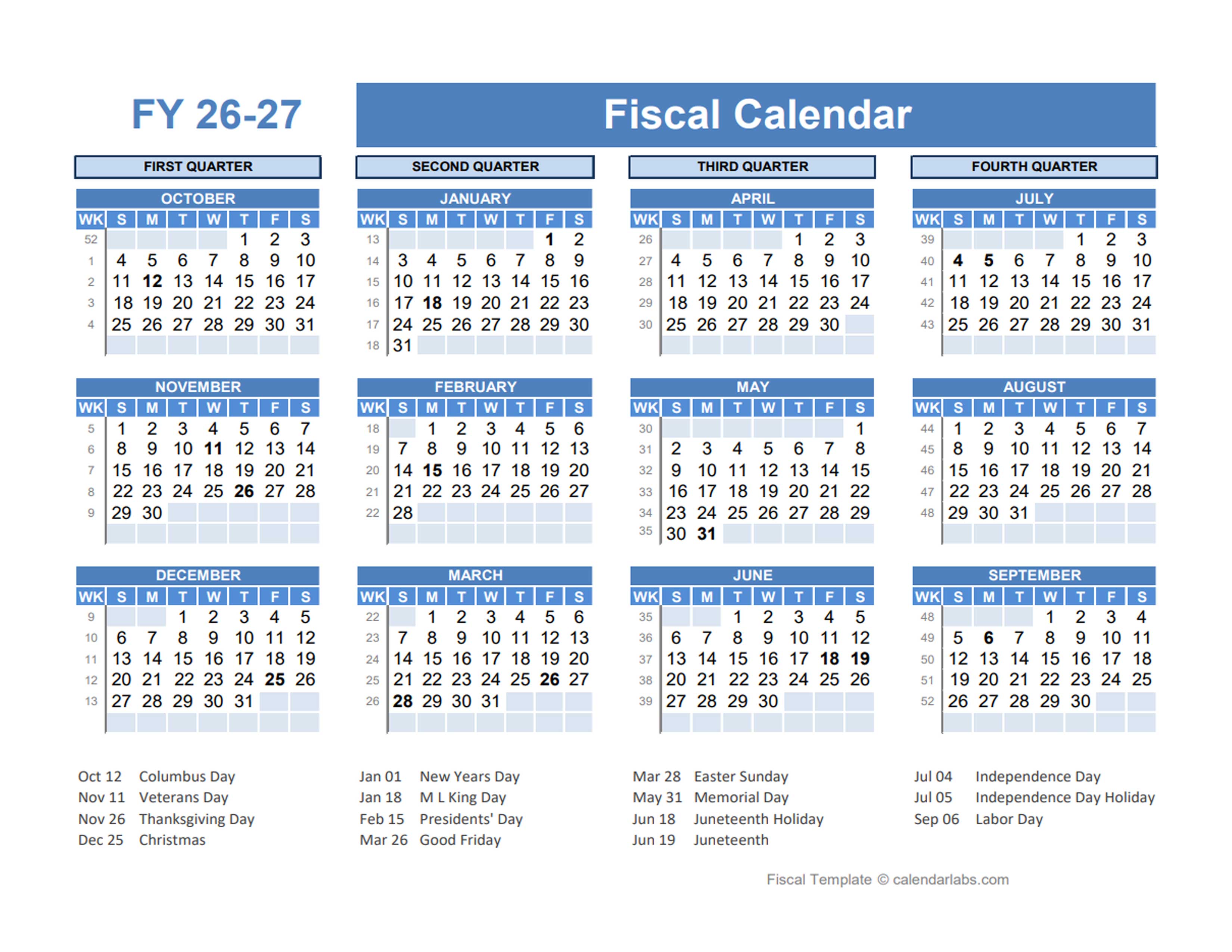

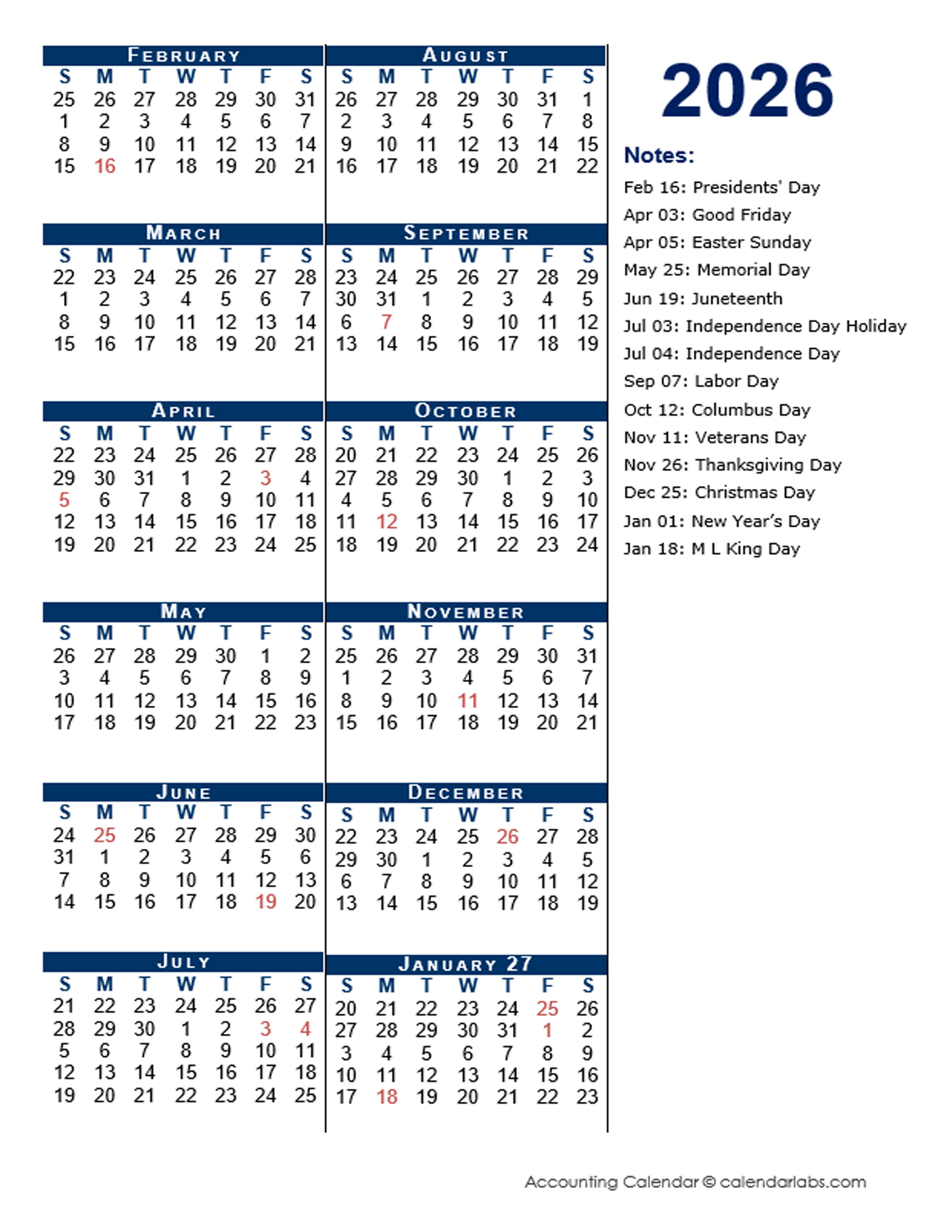

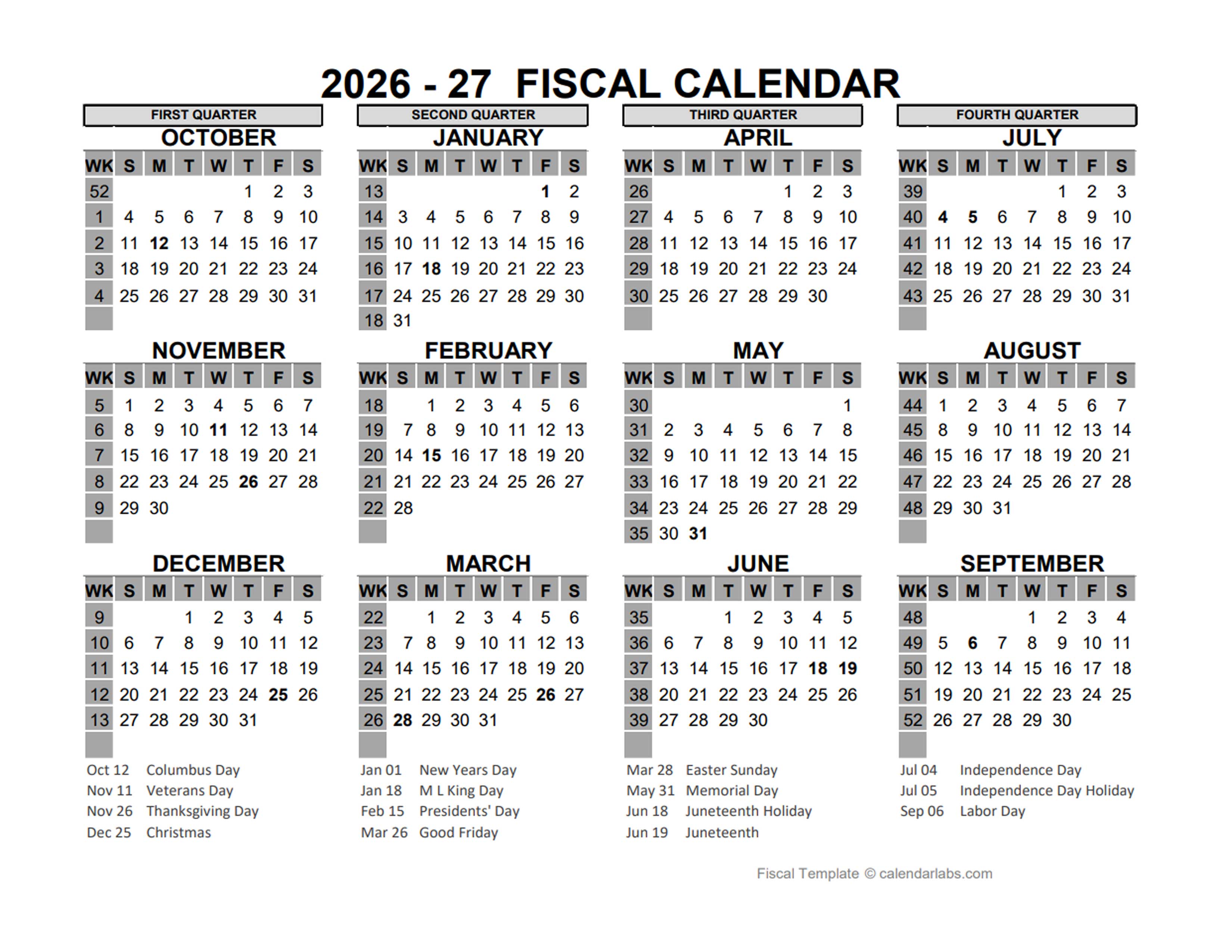

The fiscal year (FY) is a 12-month period that aligns with the financial reporting cycle of an organization. It does not necessarily correspond to the calendar year (January to December). In the United States, the federal government operates on a fiscal year that begins on October 1st and ends on September 30th of the following year. This means FY 2026 encompasses the period from October 1, 2025, to September 30, 2026.

Pay periods, on the other hand, are distinct timeframes within the fiscal year for calculating and disbursing employee salaries and wages. These periods can be weekly, bi-weekly, semi-monthly, or monthly, depending on the organization’s policies.

Key Features of the FY 2026 Pay Period Calendar

The FY 2026 pay period calendar provides a structured framework for payroll processing. It outlines the specific dates for:

- Payday: The date when employees receive their salaries or wages.

- Payroll cutoff date: The deadline for submitting time and attendance records for payroll calculations.

- Tax filing deadlines: The deadlines for submitting various tax-related forms and payments.

Benefits of Using a Pay Period Calendar

The FY 2026 pay period calendar offers numerous benefits, including:

- Improved payroll accuracy: By adhering to a predefined schedule, organizations can minimize errors and ensure timely and accurate payroll processing.

- Enhanced financial planning: A clear understanding of pay dates allows for effective budgeting and financial forecasting.

- Streamlined tax compliance: The calendar helps organizations stay on top of tax obligations and deadlines, avoiding penalties and legal issues.

- Improved employee satisfaction: Predictable pay dates contribute to employee satisfaction and financial stability.

Factors Influencing the FY 2026 Pay Period Calendar

Several factors can influence the specific dates within the FY 2026 pay period calendar, including:

- Holidays: National and local holidays may shift payday dates.

- Weekends: Paydays often fall on weekdays, so weekends can impact the timing of payroll processing.

- Payroll system: The organization’s payroll system and its capabilities can influence the calendar’s structure.

Accessing the FY 2026 Pay Period Calendar

Organizations typically create and disseminate their own internal pay period calendars. However, some resources can provide general guidelines and templates for creating a calendar. These resources may include:

- Payroll software providers: Companies offering payroll software often provide calendar templates or tools.

- Government websites: Federal and state government websites may offer information on payroll regulations and deadlines.

- Professional organizations: Organizations like the American Payroll Association (APA) provide resources and guidance for payroll professionals.

Frequently Asked Questions (FAQs) about the FY 2026 Pay Period Calendar

Q: What is the difference between a fiscal year and a calendar year?

A: A fiscal year is a 12-month period used for financial reporting purposes, while a calendar year is the standard 12-month period from January to December. The fiscal year for the federal government in the United States begins on October 1st and ends on September 30th of the following year.

Q: How often are pay periods typically scheduled?

A: Pay periods can be weekly, bi-weekly, semi-monthly, or monthly, depending on the organization’s policies and preferences.

Q: How can I access the FY 2026 pay period calendar for my organization?

A: Contact your human resources department or payroll administrator for access to the specific pay period calendar for your organization.

Q: What happens if a payday falls on a holiday?

A: In most cases, paydays are adjusted to the next business day if they fall on a holiday. However, specific policies may vary based on the organization’s guidelines.

Tips for Using the FY 2026 Pay Period Calendar

- Review the calendar regularly: Stay informed about upcoming pay dates and deadlines.

- Mark important dates: Highlight key dates such as paydays, payroll cutoff dates, and tax filing deadlines.

- Communicate with employees: Ensure that employees are aware of the pay period calendar and its implications.

- Plan ahead: Use the calendar to anticipate and plan for payroll-related expenses and financial obligations.

Conclusion

The FY 2026 pay period calendar serves as a vital tool for organizations to streamline payroll processing, improve financial planning, and ensure compliance with tax regulations. By understanding the calendar and its implications, organizations can foster a smooth and efficient payroll system, ultimately contributing to employee satisfaction and financial stability.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Fiscal Year 2026 Pay Period Calendar: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!