Navigating the Fiscal Year 2026: A Comprehensive Guide

Related Articles: Navigating the Fiscal Year 2026: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Fiscal Year 2026: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Fiscal Year 2026: A Comprehensive Guide

The fiscal year, a distinct accounting period that governments and many organizations utilize, plays a crucial role in financial planning, budgeting, and performance evaluation. Understanding the fiscal year calendar is essential for individuals and entities operating within these frameworks. This article provides a comprehensive overview of the 2026 fiscal year calendar, shedding light on its importance, benefits, and practical implications.

Defining the Fiscal Year:

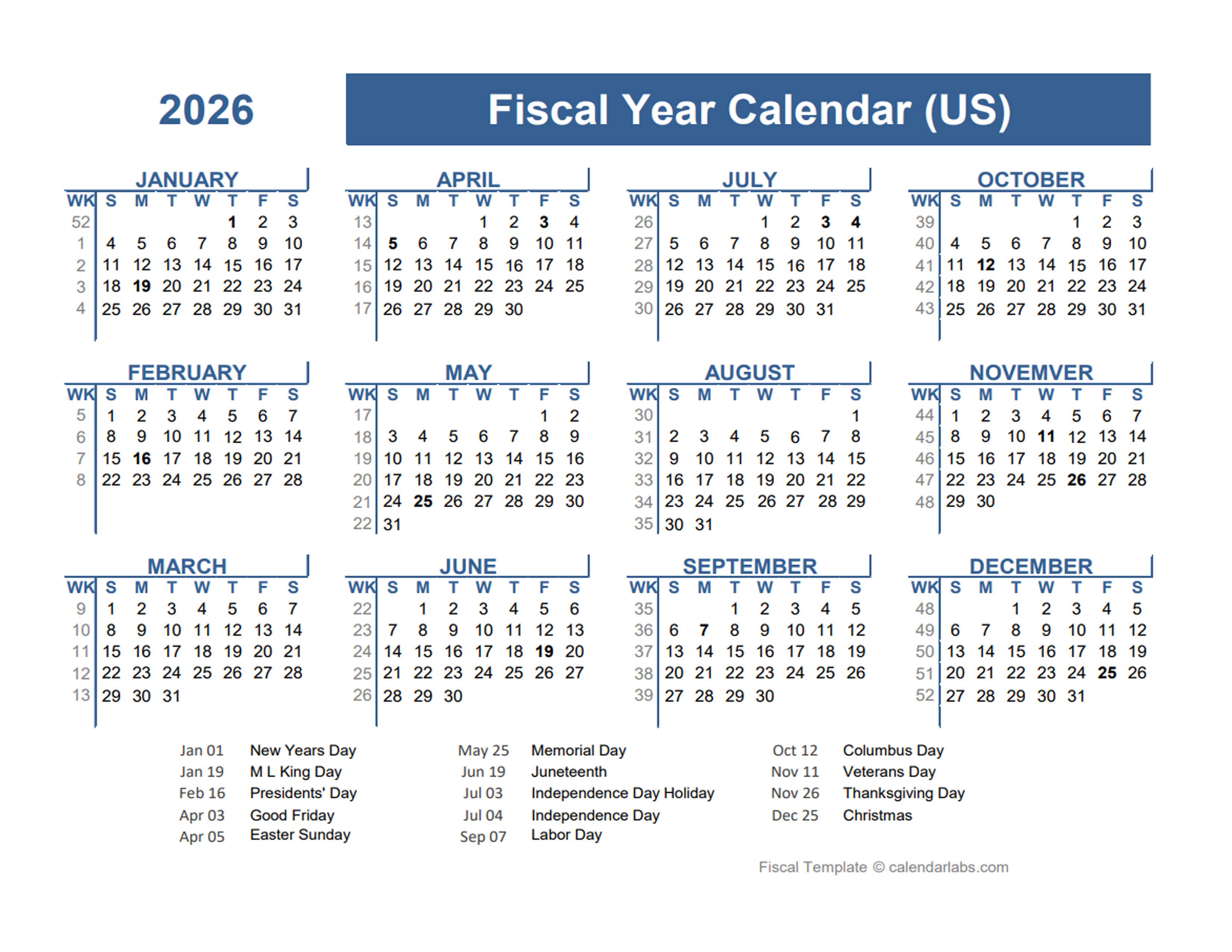

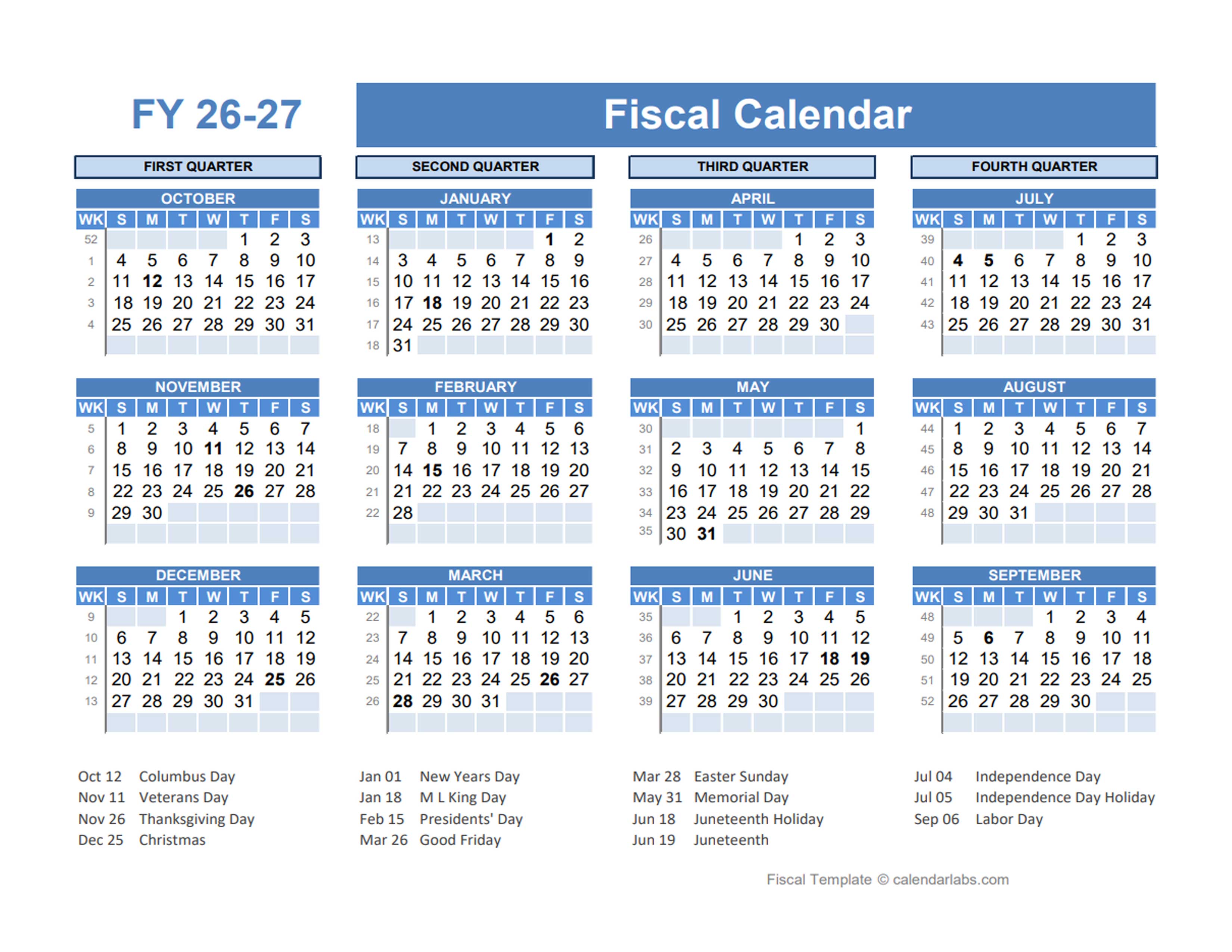

The fiscal year, unlike the calendar year, does not necessarily align with the Gregorian calendar’s January to December timeframe. It is a defined period of 12 months, typically starting on a specific date and ending on another. This date varies depending on the country or organization. The United States, for example, adopts a fiscal year that runs from October 1st to September 30th.

Importance of the Fiscal Year Calendar:

The fiscal year calendar holds significant importance for several reasons:

- Financial Planning and Budgeting: It provides a structured framework for planning and budgeting financial activities. Organizations allocate resources, set spending targets, and track performance based on the fiscal year.

- Performance Evaluation: The fiscal year serves as a benchmark for assessing an organization’s financial performance, allowing for consistent measurement and comparison over time.

- Government Funding and Operations: Governments operate on fiscal year cycles, determining budget allocations, enacting policies, and managing public funds within this framework.

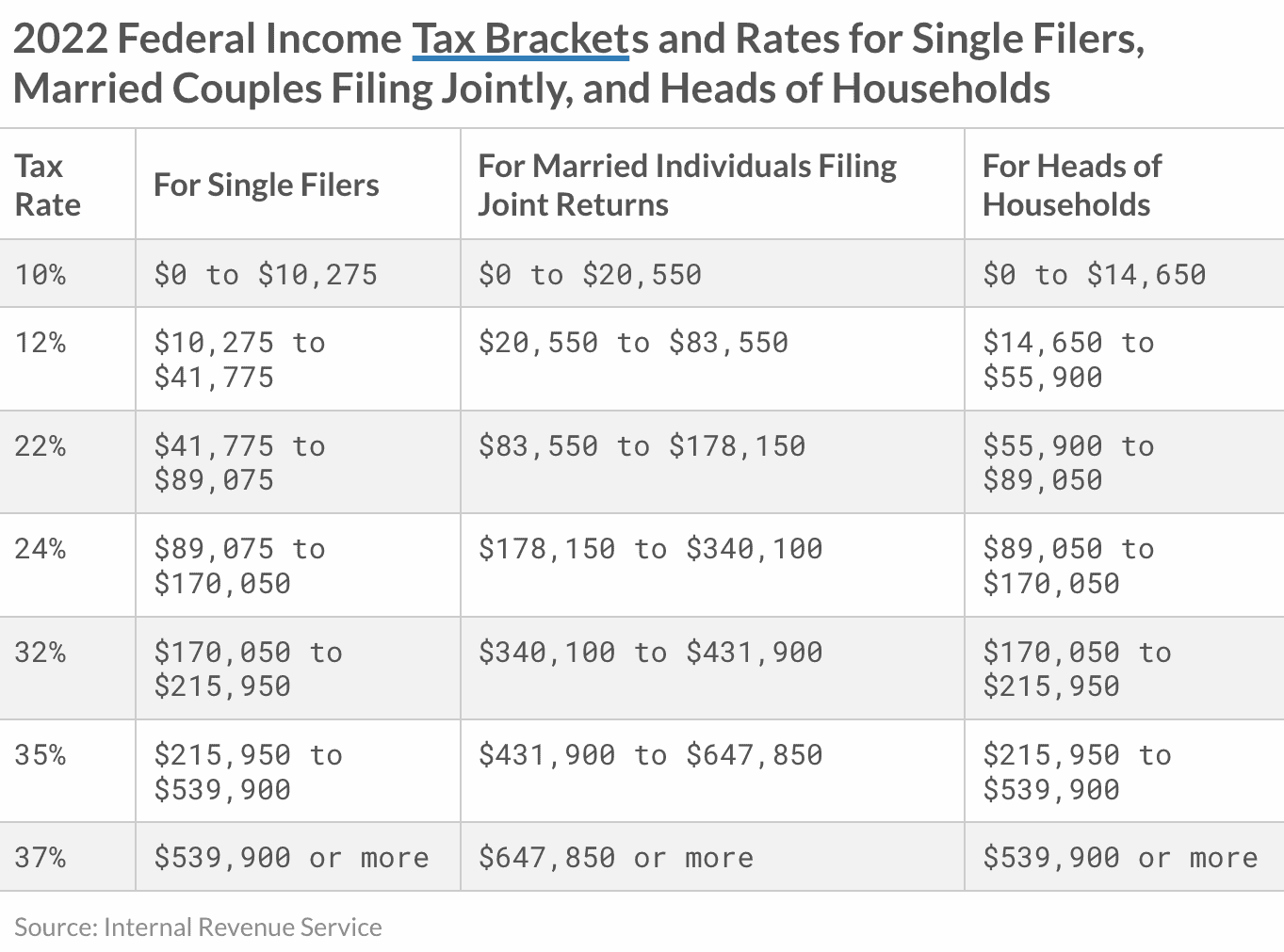

- Taxation and Reporting: Tax obligations, financial reporting, and regulatory compliance often adhere to the fiscal year, ensuring consistency and clarity in financial records.

The 2026 Fiscal Year Calendar:

While the specific start and end dates of the 2026 fiscal year vary depending on the entity, the general calendar structure provides a framework for understanding the key milestones and periods.

For the United States, the 2026 fiscal year begins on October 1, 2025, and ends on September 30, 2026. This timeframe is crucial for various governmental and organizational activities, including:

- Federal Budget Process: The annual budget cycle, encompassing the drafting, approval, and implementation of the federal budget, takes place within the fiscal year.

- Tax Filing and Payment Deadlines: Individuals and businesses must file their tax returns and make tax payments according to the fiscal year schedule.

- Government Funding Allocations: Federal agencies receive funding based on the fiscal year budget, impacting their operations and program implementation.

Understanding the 2026 Fiscal Year Calendar:

To effectively navigate the 2026 fiscal year, consider the following key aspects:

- Fiscal Year Quarters: The fiscal year is typically divided into four quarters, each spanning three months. This quarterly breakdown allows for more granular financial tracking and reporting.

- Fiscal Year End: The end of the fiscal year marks a crucial period for financial reporting, auditing, and performance evaluation. Organizations must ensure accurate and timely completion of these tasks.

- Fiscal Year Start: The beginning of the fiscal year provides an opportunity for strategic planning, setting financial goals, and allocating resources for the upcoming year.

Benefits of Using a Fiscal Year Calendar:

The use of a fiscal year calendar offers several benefits:

- Improved Financial Management: It provides a structured approach to financial planning, budgeting, and control, leading to more efficient resource allocation and better financial performance.

- Enhanced Accountability: The fiscal year framework promotes accountability by establishing clear deadlines for reporting, performance evaluation, and compliance.

- Consistency and Comparability: The standardized fiscal year structure ensures consistency in financial data and allows for meaningful comparisons across different periods and organizations.

FAQs Regarding the 2026 Fiscal Year Calendar:

Q: How does the fiscal year differ from the calendar year?

A: The fiscal year is an accounting period that does not necessarily align with the calendar year’s January to December timeframe. It is a defined 12-month period with a specific start and end date, which can vary depending on the country or organization.

Q: Why is the 2026 fiscal year important for government operations?

A: The fiscal year governs the budget cycle, funding allocations, and policy implementation for government agencies. It provides a framework for managing public funds and ensuring the smooth operation of government programs.

Q: What are the key milestones within the 2026 fiscal year?

A: Key milestones include the start and end of the fiscal year, quarterly financial reporting deadlines, and the federal budget process.

Q: How can individuals and organizations prepare for the 2026 fiscal year?

A: Individuals and organizations should familiarize themselves with the fiscal year calendar, understand relevant deadlines, and plan their financial activities accordingly.

Tips for Navigating the 2026 Fiscal Year:

- Plan Ahead: Develop a comprehensive financial plan, setting clear goals and objectives for the fiscal year.

- Stay Informed: Stay updated on relevant fiscal year deadlines, regulations, and policy changes.

- Track Progress: Monitor financial performance regularly and adjust plans as needed.

- Seek Professional Guidance: Consult with financial experts for guidance on tax planning, budgeting, and compliance.

Conclusion:

The 2026 fiscal year calendar is a critical framework for financial management, government operations, and individual planning. Understanding its structure, key milestones, and benefits allows for more effective financial planning, performance evaluation, and compliance with relevant regulations. By embracing the principles of fiscal year management, individuals and organizations can enhance their financial well-being and achieve their goals within this defined timeframe.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Fiscal Year 2026: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!