Navigating the Federal Pay Calendar for 2026: A Comprehensive Guide

Related Articles: Navigating the Federal Pay Calendar for 2026: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Federal Pay Calendar for 2026: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Federal Pay Calendar for 2026: A Comprehensive Guide

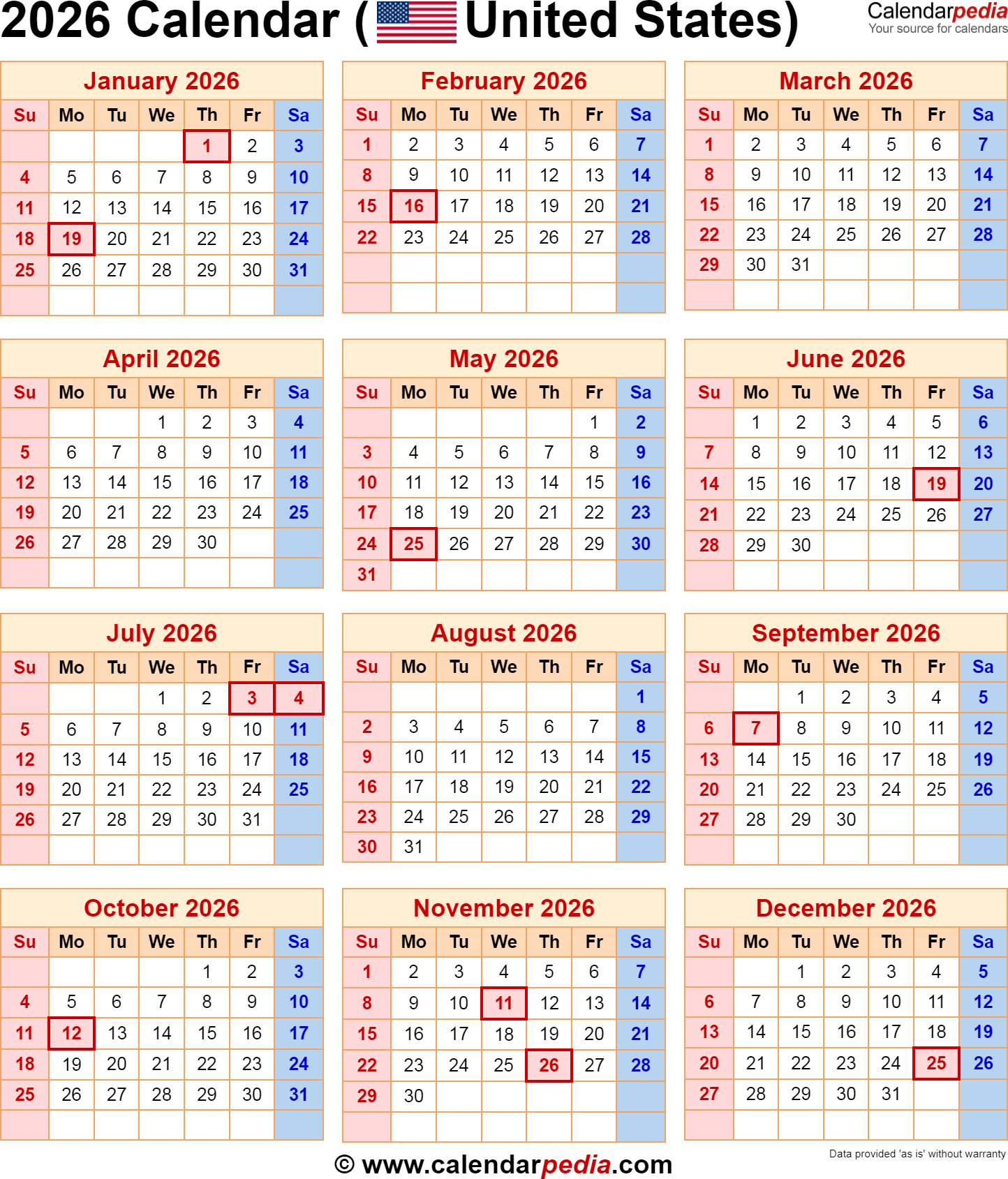

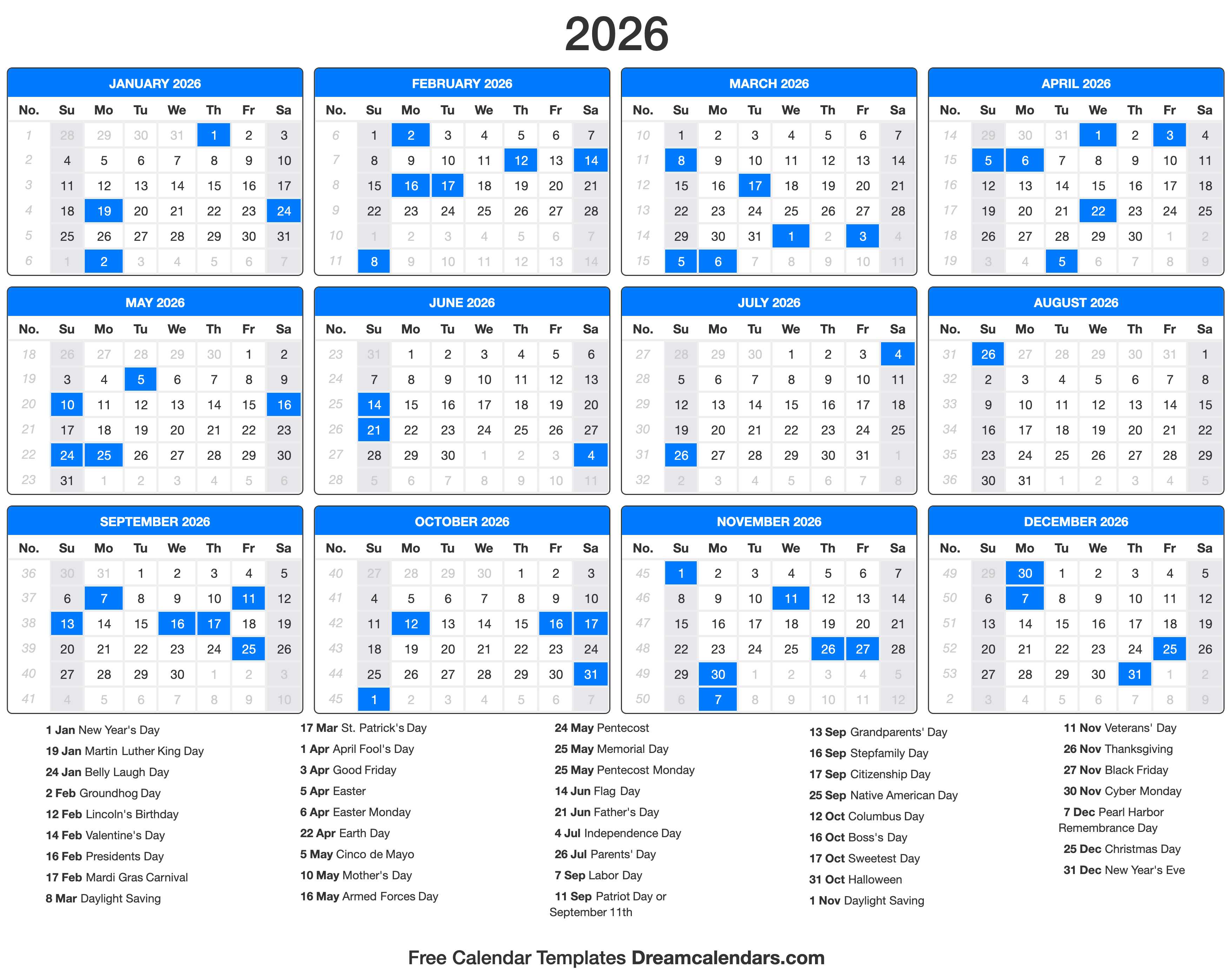

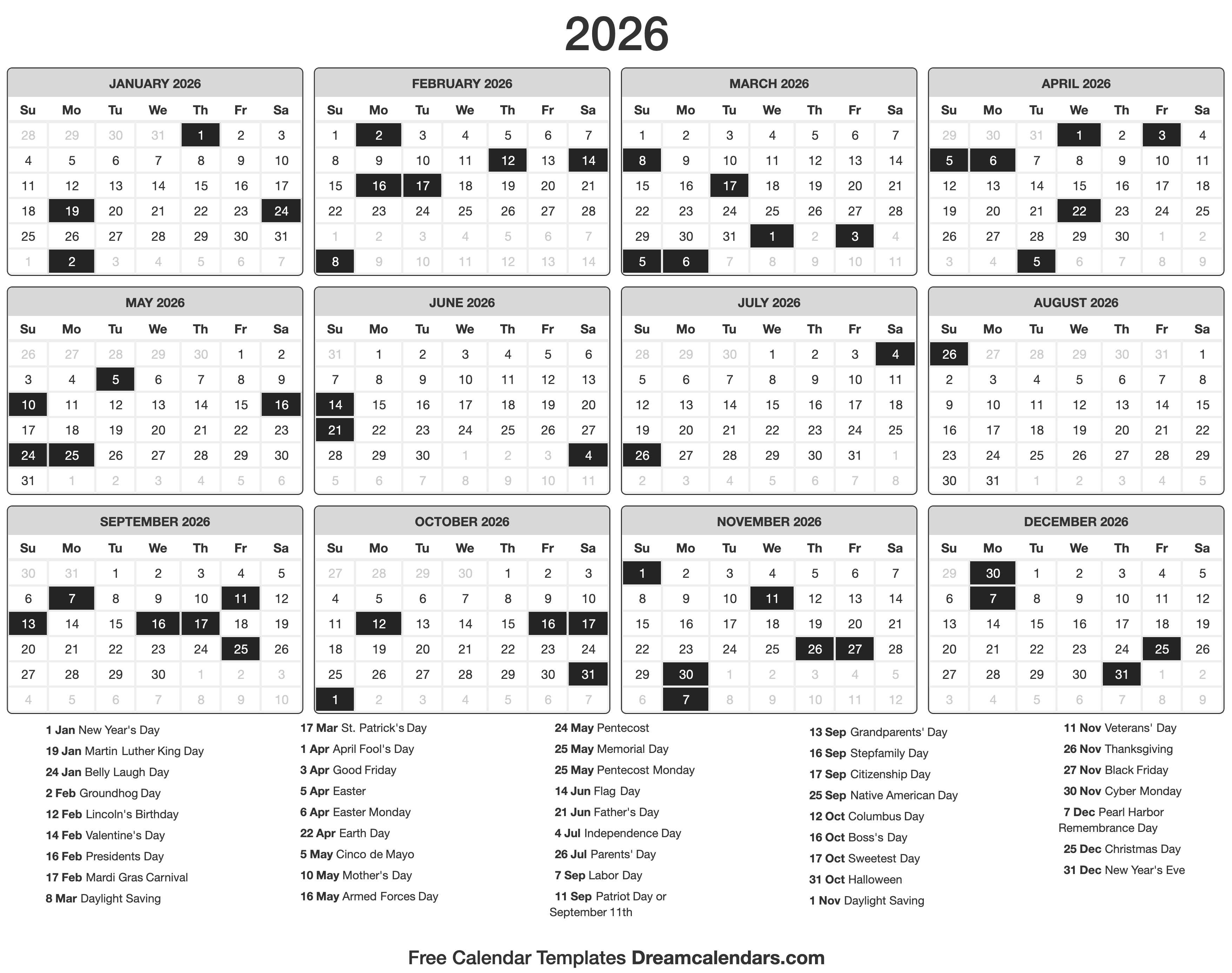

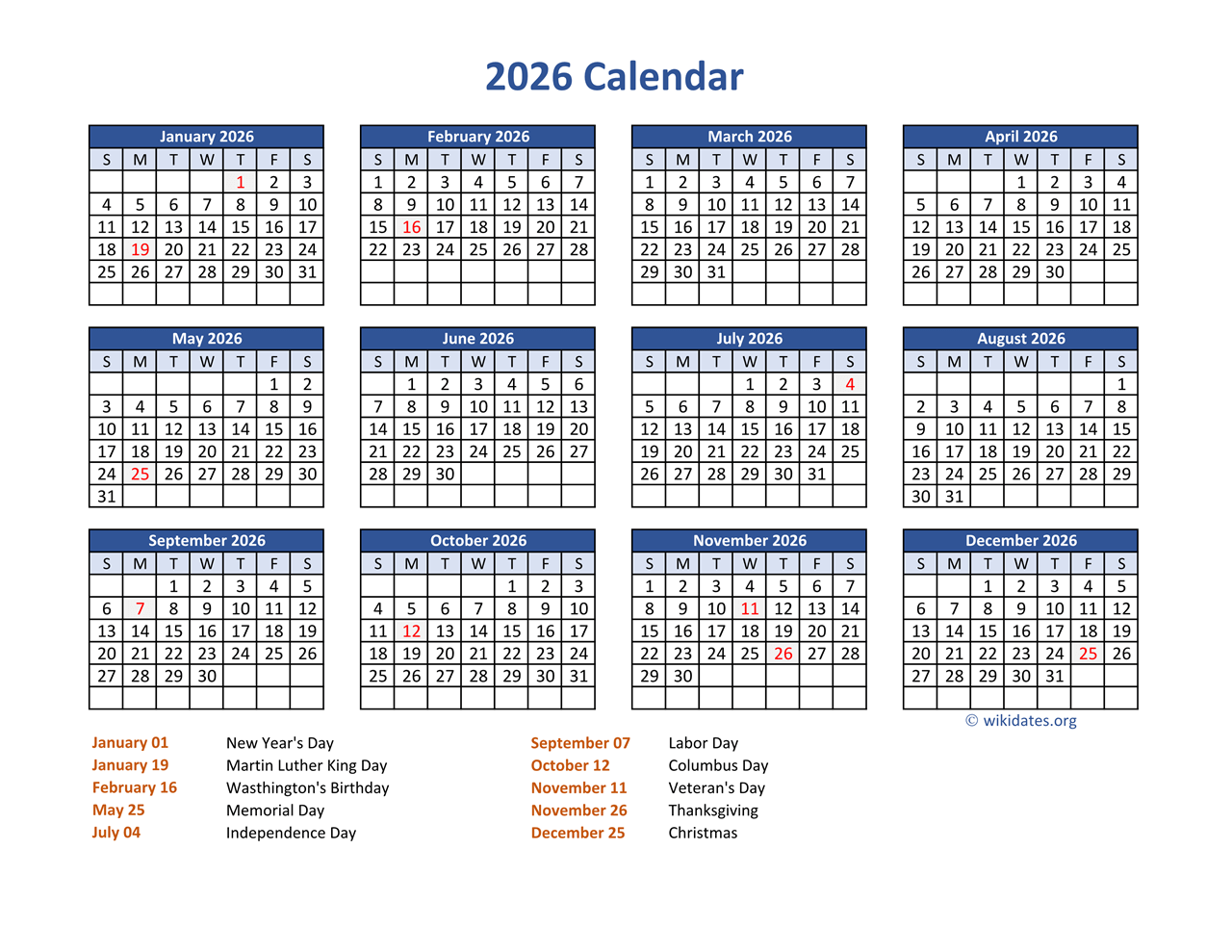

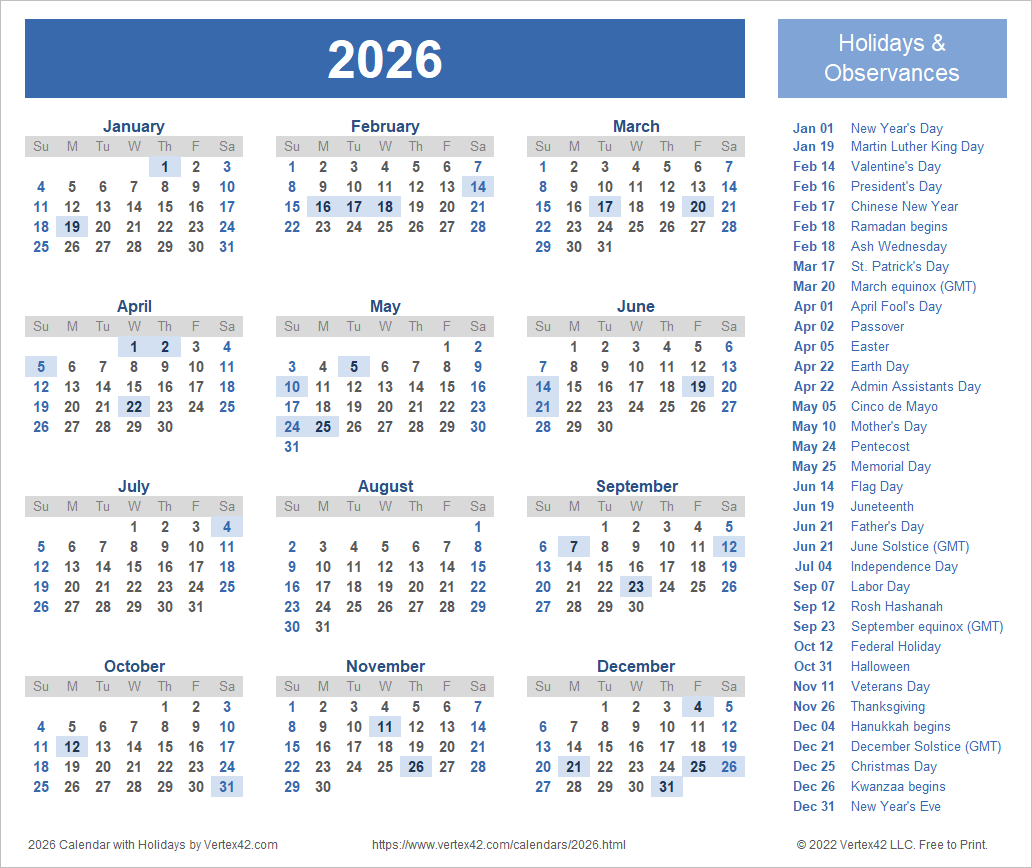

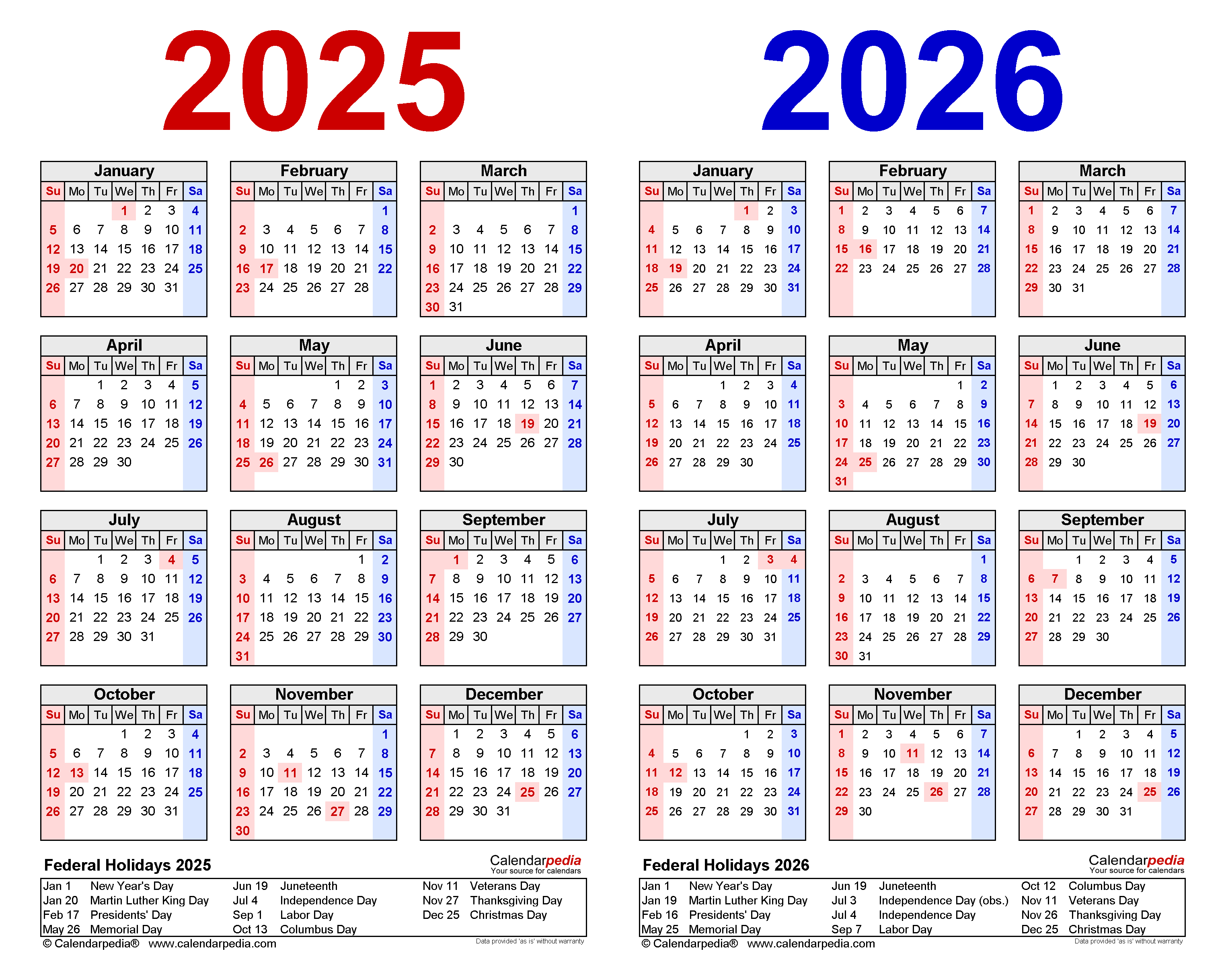

The federal pay calendar for 2026 provides a crucial roadmap for federal employees, outlining pay dates, holidays, and other important information related to their compensation. Understanding this calendar is essential for effective financial planning and ensuring timely receipt of wages. This guide aims to provide a comprehensive overview of the federal pay calendar for 2026, outlining its key features and highlighting its significance for federal employees.

Understanding the Federal Pay Calendar

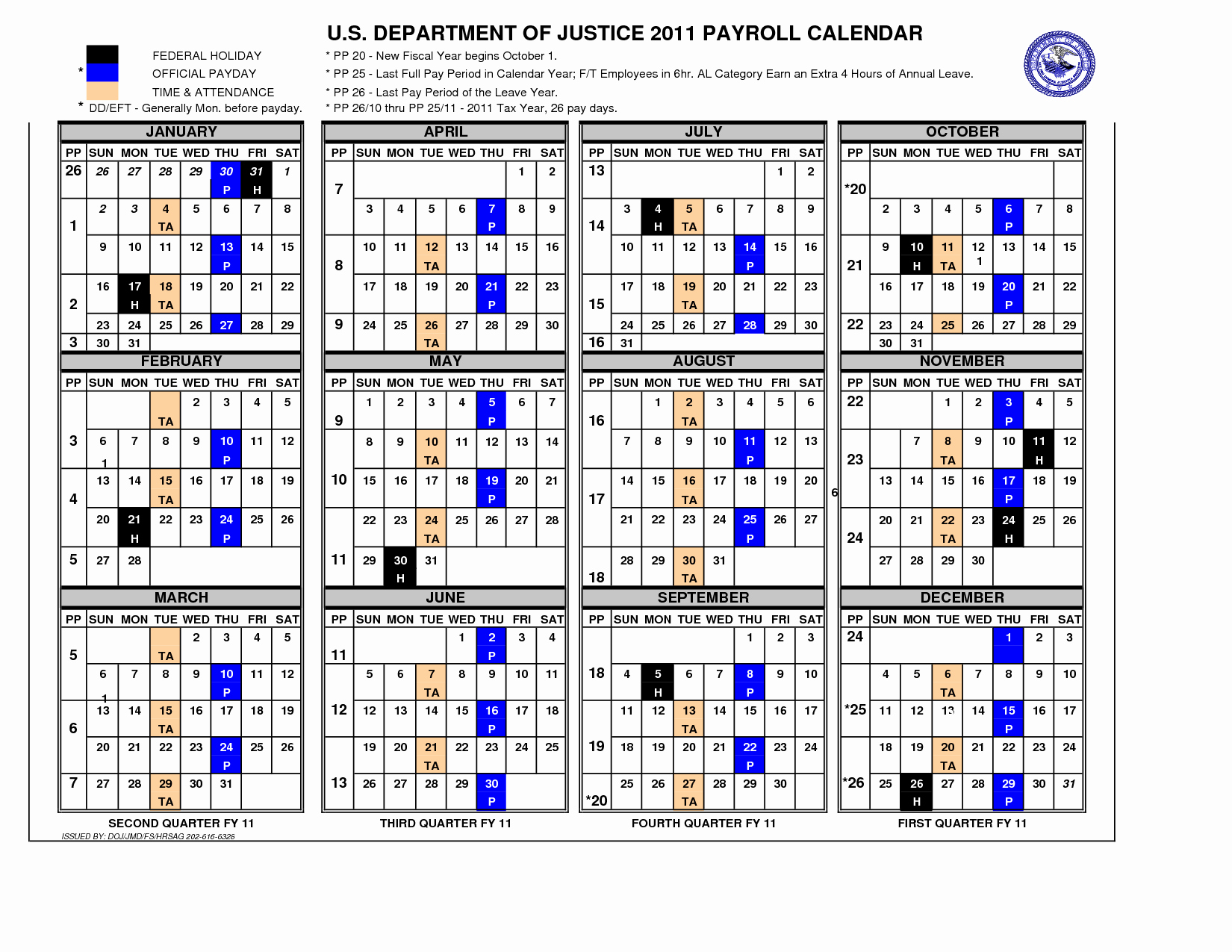

The federal pay calendar is a meticulously crafted document that details the specific dates on which federal employees can expect to receive their paychecks throughout the year. It takes into account various factors, including:

- Federal holidays: These are designated days when federal offices are closed, and employees are typically granted paid leave. The calendar accurately reflects the impact of holidays on pay dates.

- Pay periods: Federal employees are typically paid bi-weekly, meaning they receive a paycheck every two weeks. The calendar outlines the start and end dates for each pay period, ensuring clarity on when to expect payments.

- Payroll processing: The calendar accounts for the time required to process payroll, ensuring that paychecks are issued in a timely manner.

Key Features of the 2026 Federal Pay Calendar

The 2026 federal pay calendar is expected to feature the following key elements:

- Regular pay dates: These are the standard dates on which federal employees receive their paychecks. The calendar clearly specifies these dates for the entire year, providing employees with a predictable schedule for their income.

- Holiday pay dates: For federal holidays that fall within a pay period, employees are entitled to receive holiday pay. The calendar accurately reflects these pay dates, ensuring employees are compensated for their time off.

- Year-end adjustments: The calendar may also include information regarding year-end adjustments, such as bonuses or additional payments, ensuring employees are informed about any potential changes to their compensation.

Importance of the Federal Pay Calendar

The federal pay calendar plays a crucial role in the lives of federal employees, providing them with:

- Financial stability: The calendar’s predictability allows employees to budget effectively, knowing when to expect their income. This fosters financial stability and reduces stress related to managing finances.

- Timely compensation: The calendar ensures that employees receive their paychecks on time, preventing delays and potential financial hardship.

- Transparency and accountability: The calendar provides transparency regarding pay dates and holiday schedules, fostering trust and accountability between the government and its employees.

Benefits of Using the Federal Pay Calendar

Utilizing the federal pay calendar offers numerous benefits to federal employees:

- Improved financial planning: The calendar allows employees to accurately forecast their income and expenses, enabling better financial management and planning for future goals.

- Reduced stress and uncertainty: Knowing when to expect paychecks eliminates the stress and uncertainty associated with fluctuating income, promoting peace of mind and a sense of security.

- Enhanced communication: The calendar serves as a valuable tool for communication between employees and their supervisors, facilitating discussions about pay dates and any potential adjustments.

FAQs about the Federal Pay Calendar for 2026

Q: Where can I find the 2026 federal pay calendar?

A: The federal pay calendar is typically published by the Office of Personnel Management (OPM) on their official website. It is also often available through employee portals or other relevant resources.

Q: What happens if a holiday falls on a weekend?

A: Federal holidays that fall on a weekend are typically observed on the preceding Friday or the following Monday. The calendar will reflect the adjusted pay dates accordingly.

Q: Can my pay date change throughout the year?

A: While the pay dates are generally fixed, they can be adjusted due to unforeseen circumstances, such as government shutdowns or other emergencies. The calendar will provide updated information if any changes occur.

Q: What if I have questions about my pay or the pay calendar?

A: If you have any questions regarding your pay or the federal pay calendar, you should contact your agency’s payroll office or HR department for clarification.

Tips for Utilizing the Federal Pay Calendar

- Download and save the calendar: Save a copy of the calendar for easy reference throughout the year.

- Mark important dates: Highlight or circle key dates, such as pay dates and holidays, for better visibility.

- Use the calendar for budgeting: Incorporate the pay dates into your budgeting process for effective financial planning.

- Stay informed of any updates: Regularly check for any updates or changes to the calendar.

Conclusion

The federal pay calendar for 2026 is a valuable resource for federal employees, providing essential information regarding their compensation. By understanding its key features, benefits, and implications, employees can navigate their finances effectively, ensure timely receipt of wages, and maintain financial stability. Utilizing the calendar wisely can empower employees to plan for the future, manage their finances effectively, and foster a sense of security and peace of mind.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Federal Pay Calendar for 2026: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!