Navigating the 2026 Bi-Weekly Pay Period Calendar: A Comprehensive Guide

Related Articles: Navigating the 2026 Bi-Weekly Pay Period Calendar: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the 2026 Bi-Weekly Pay Period Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2026 Bi-Weekly Pay Period Calendar: A Comprehensive Guide

The 2026 bi-weekly pay period calendar serves as a vital tool for individuals and organizations alike, providing a clear framework for payroll processing, financial planning, and workforce management. This calendar details the specific dates on which employees receive their paychecks, ensuring consistent and predictable income streams.

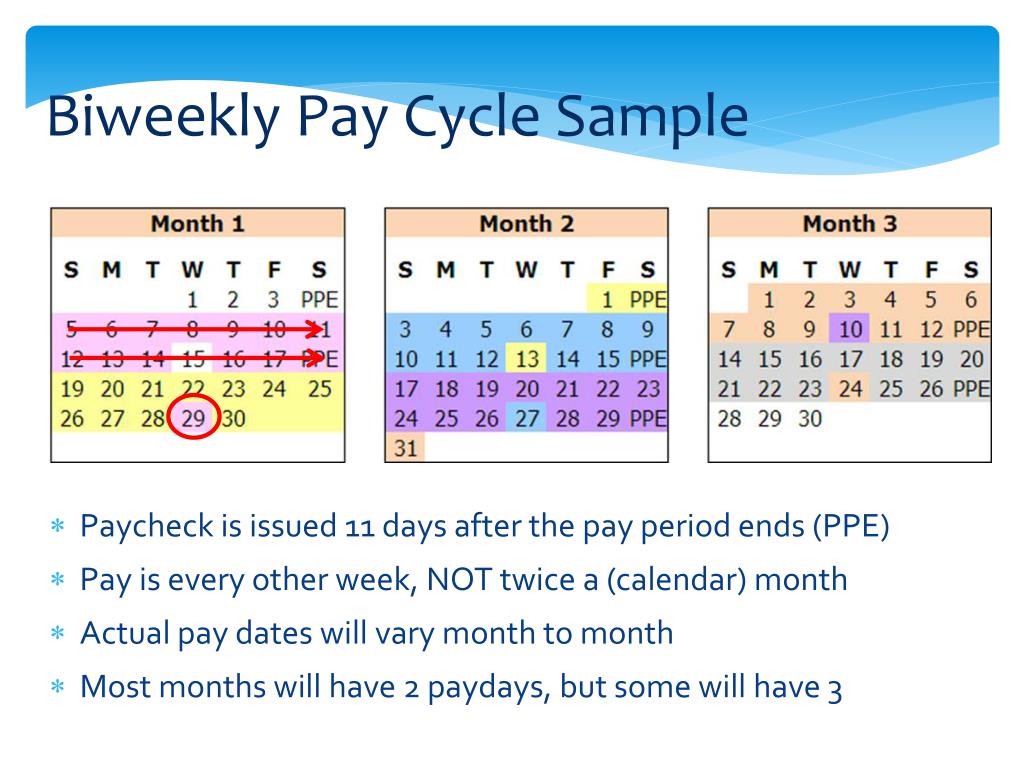

Understanding the Bi-Weekly Pay Period System

A bi-weekly pay period system designates paychecks to be issued every two weeks. This consistent frequency offers several advantages:

- Predictable Income: Employees receive their paychecks on a regular schedule, facilitating budgeting and financial planning.

- Improved Cash Flow Management: Businesses can anticipate their payroll obligations with greater accuracy, streamlining cash flow management and financial stability.

- Enhanced Employee Satisfaction: Regular paychecks contribute to employee satisfaction and financial well-being, fostering a positive work environment.

The 2026 Bi-Weekly Pay Period Calendar: A Detailed Breakdown

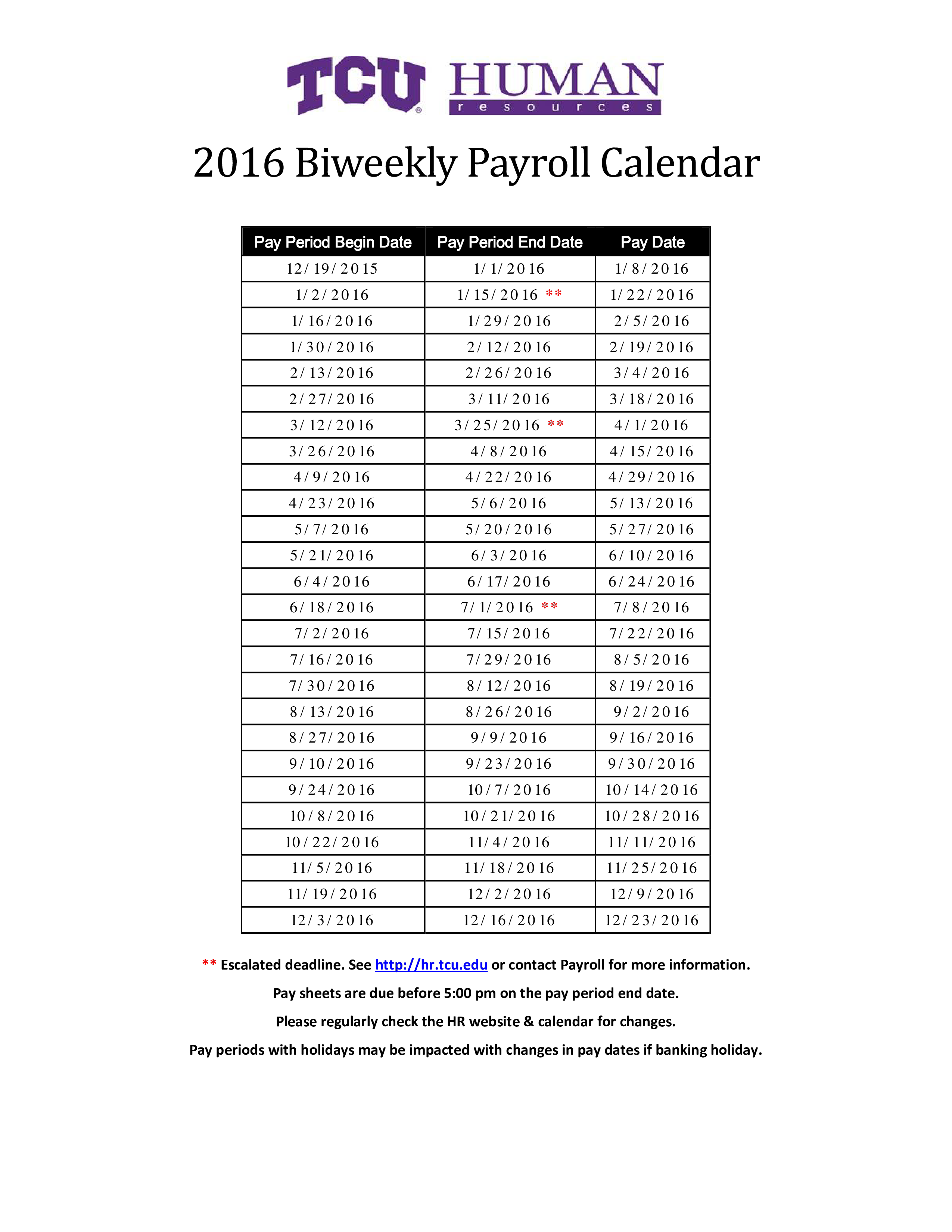

The 2026 bi-weekly pay period calendar comprises 26 pay periods, each spanning two weeks. The specific dates of each pay period can vary slightly depending on the chosen starting date and the inclusion of holidays.

Key Considerations:

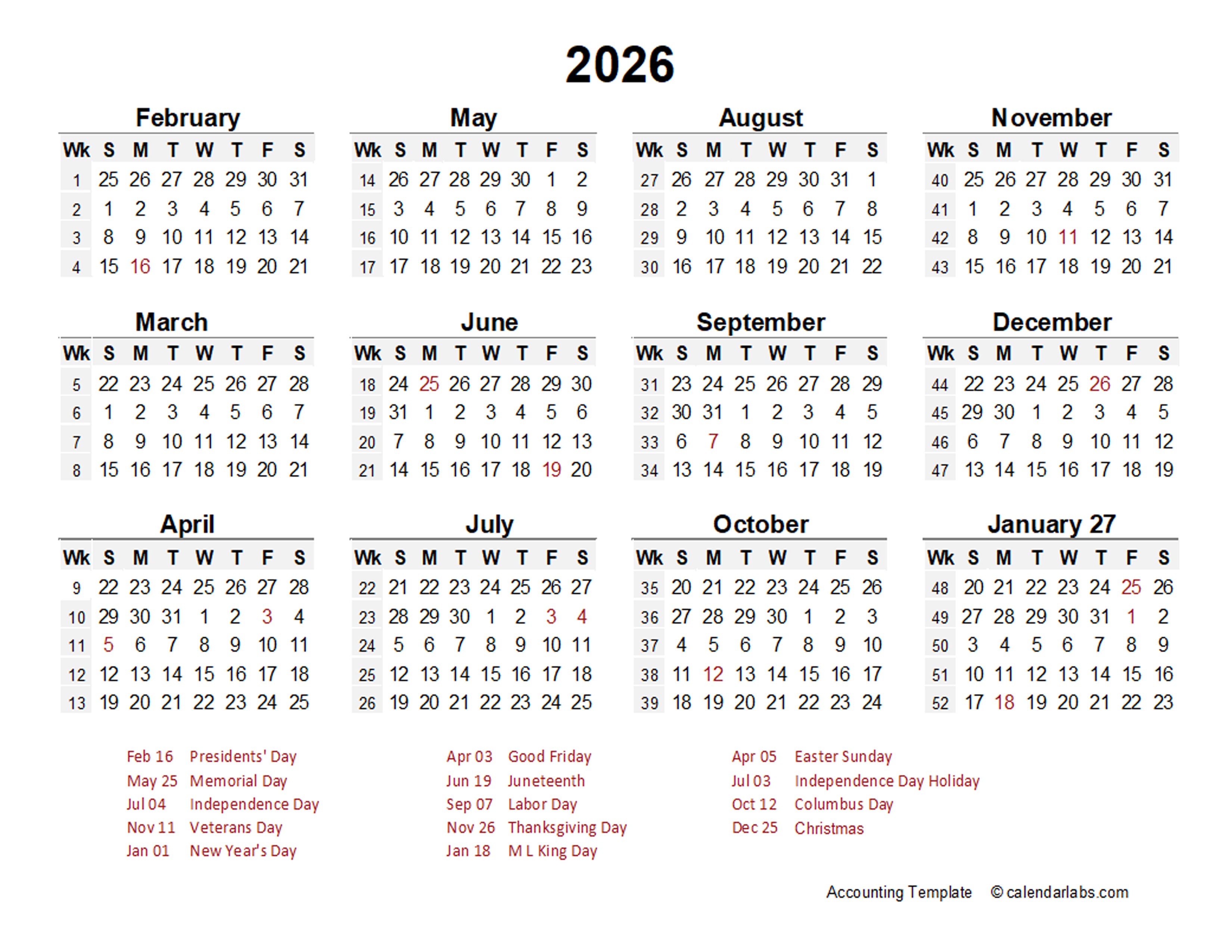

- Leap Year: 2026 is not a leap year, so there are no adjustments to be made for an extra day in February.

- Holidays: The calendar should account for any observed holidays that fall within a pay period, as these may impact the pay date.

- Weekends: Pay periods generally encompass both weekdays and weekends, ensuring a consistent pay frequency regardless of the day of the week.

Benefits of Utilizing the 2026 Bi-Weekly Pay Period Calendar:

- Accurate Payroll Processing: The calendar ensures that paychecks are issued on the correct dates, minimizing errors and improving payroll efficiency.

- Improved Financial Planning: Individuals can anticipate their income and plan their spending accordingly, enhancing financial stability and reducing stress.

- Effective Workforce Management: Businesses can utilize the calendar to schedule payroll processing, optimize staffing levels, and ensure smooth operations.

- Enhanced Communication and Transparency: The calendar provides a clear and transparent framework for pay dates, fostering trust and communication between employers and employees.

Frequently Asked Questions (FAQs) about the 2026 Bi-Weekly Pay Period Calendar:

Q: How can I find a 2026 bi-weekly pay period calendar?

A: Various online resources, including payroll software providers and financial websites, offer downloadable 2026 bi-weekly pay period calendars.

Q: What happens if a holiday falls within a pay period?

A: The pay date may be adjusted to accommodate the holiday, with the specific details typically outlined by the employer.

Q: Can I change my pay period frequency?

A: It is possible to change the pay period frequency, but this typically requires communication with your employer and may involve specific procedures.

Q: How can I use the calendar to improve my financial planning?

A: The calendar provides a clear schedule of pay dates, allowing you to anticipate your income and budget accordingly. You can create a budget based on your bi-weekly income and track your expenses to ensure financial stability.

Tips for Utilizing the 2026 Bi-Weekly Pay Period Calendar:

- Mark Important Dates: Highlight key dates on the calendar, such as pay dates, holidays, and other financial obligations.

- Create a Budget: Use the calendar to create a detailed budget based on your bi-weekly income, allocating funds for essential expenses, savings, and discretionary spending.

- Track Expenses: Monitor your spending regularly to ensure that you are staying within your budget and making progress towards your financial goals.

- Consider Financial Planning Tools: Utilize financial planning tools such as budgeting apps or spreadsheets to simplify your financial management and track your progress.

Conclusion:

The 2026 bi-weekly pay period calendar provides a valuable framework for individuals and organizations seeking to manage their finances and workforce effectively. By understanding the calendar’s structure and utilizing its benefits, individuals can enhance their financial planning and achieve their financial goals. For businesses, the calendar facilitates accurate payroll processing, streamlined cash flow management, and improved workforce planning, ultimately contributing to organizational efficiency and success.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2026 Bi-Weekly Pay Period Calendar: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!